Problems We Solve

Managing wealth is complex. We make it simple with expert advice and smart tech.

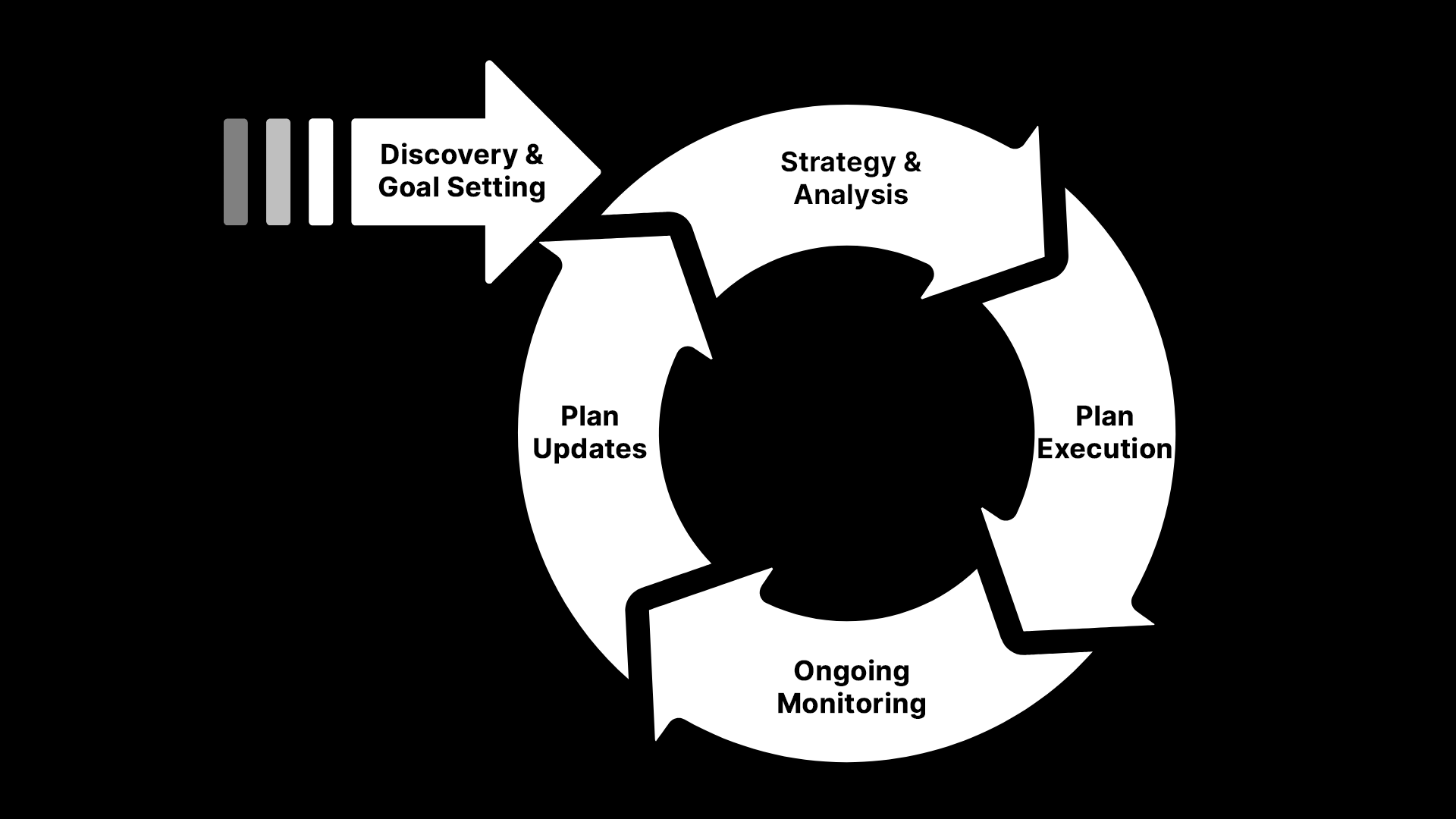

The DePaolo & May Experience

We take a four pillar approach to optimize your finances.

Why We're Different

100% Transparent - No opaque fees. No vague strategies. Just clear insight into performance, intentions, and market outlook.

100% Transparent - No opaque fees. No vague strategies. Just clear insight into performance, intentions, and market outlook.

Direct Access - No layers. No delays. You'll get real ongoing conversations with the firm's partners.

Direct Access - No layers. No delays. You'll get real ongoing conversations with the firm's partners.

No Cookie-Cutter Approach - We reject static portfolios, overpriced mutual funds, and one-size-fits-all retirement plans.

No Cookie-Cutter Approach - We reject static portfolios, overpriced mutual funds, and one-size-fits-all retirement plans.

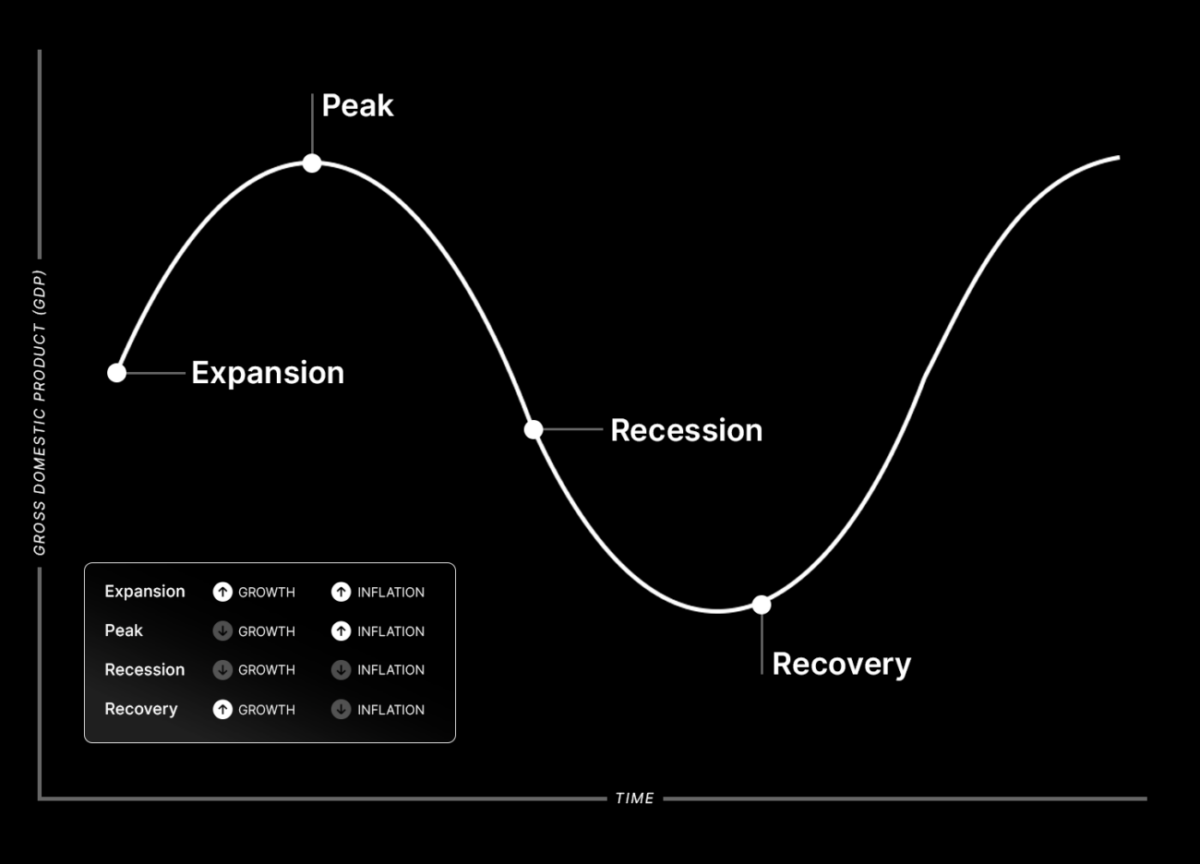

How We Invest

We take a data-driven, tactical approach to active management. Our investment strategy is anchored in the prevailing growth and inflation environment, recognizing that different phases of the business cycle favor different asset classes, sectors, and factors. By rotating exposure accordingly and refining allocations with fundamental and technical insights, we aim to build optimized portfolios for each macroeconomic backdrop.

How We Plan

We believe financial planning starts with what matters most to you. At it's core, your plan should be built around your goals, values, and how you want to use your wealth—both now and in the future. It is about understanding what you care about, what you want to accomplish, and helping you build a thoughtful strategy to get there.

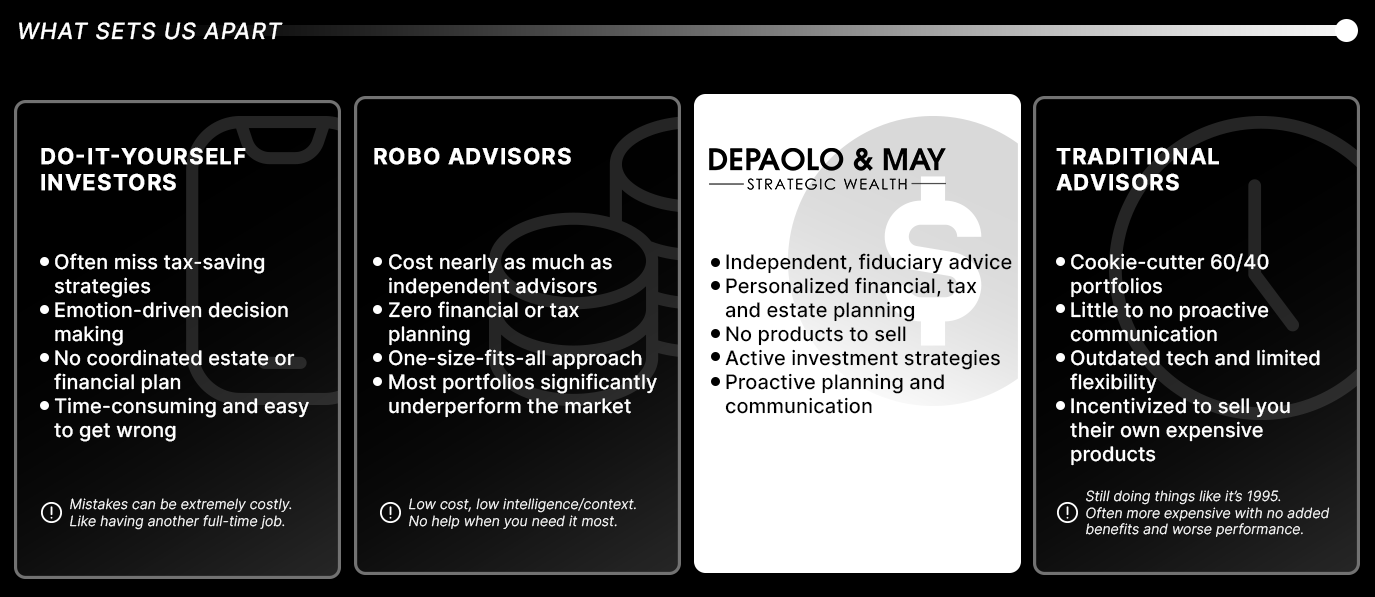

Your Options for Managing Wealth

Our Partners & Technology

Strategize With Us

Ready to achieve your financial goals?

Or fill out the form and we'll reach out within 24 hours.