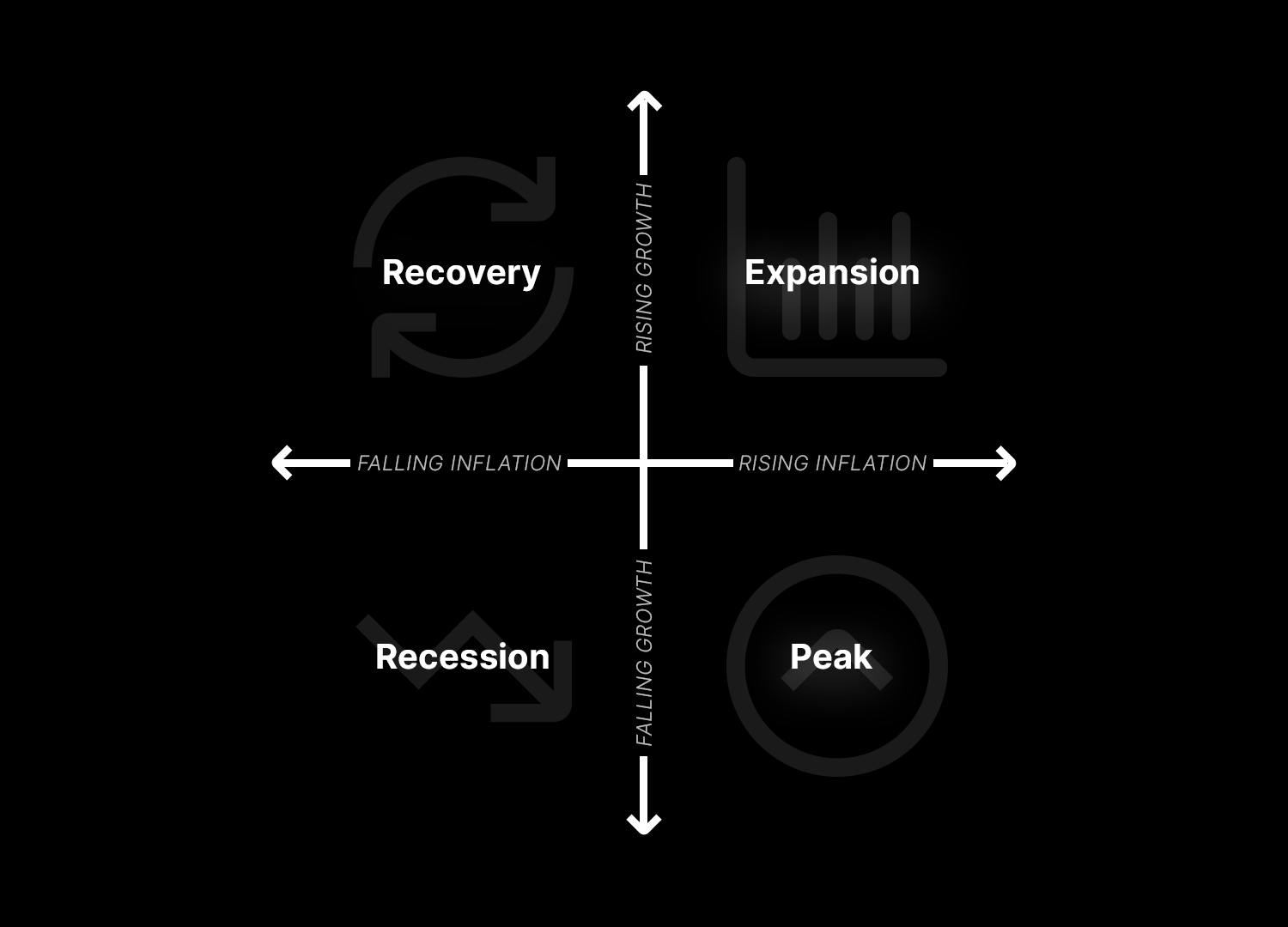

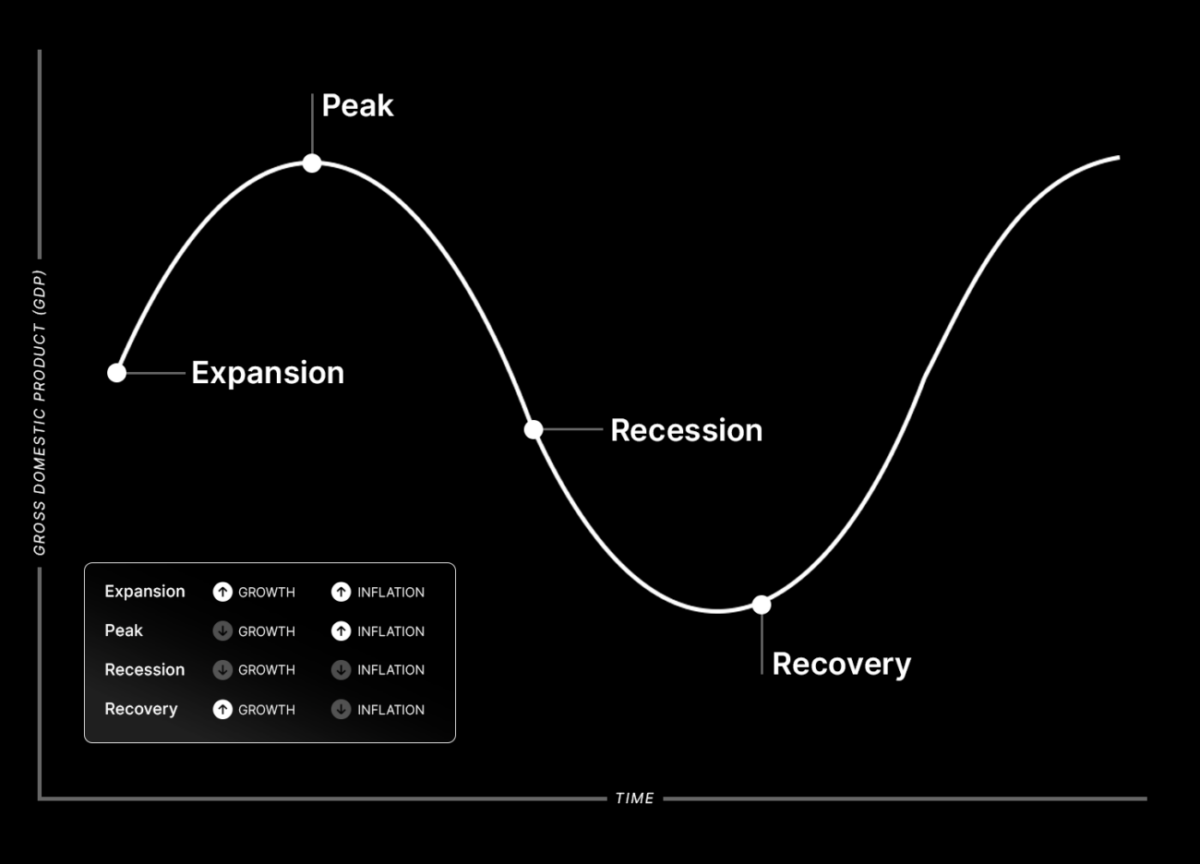

We utilize a four quadrant model to capture each distinct mix of growth and inflation (Recovery / Expansion / Peak / Recession). Each of these regimes has historically proven better for different mixes of asset classes, as well as the segments within them.

This model tends to align closely with the different phases of the typical business cycle. However, as each business cycle can be slightly different, our four quadrant model allows for greater flexibility to deal with any macro scenario that arises at any time.

Within our equities bucket, we further utilize a multifaceted system to highlight the best performing sectors and industries as a complement to our macro framework. Earnings, momentum, valuation and other components all come together to carve out the equity segments most likely to have the strongest performance.

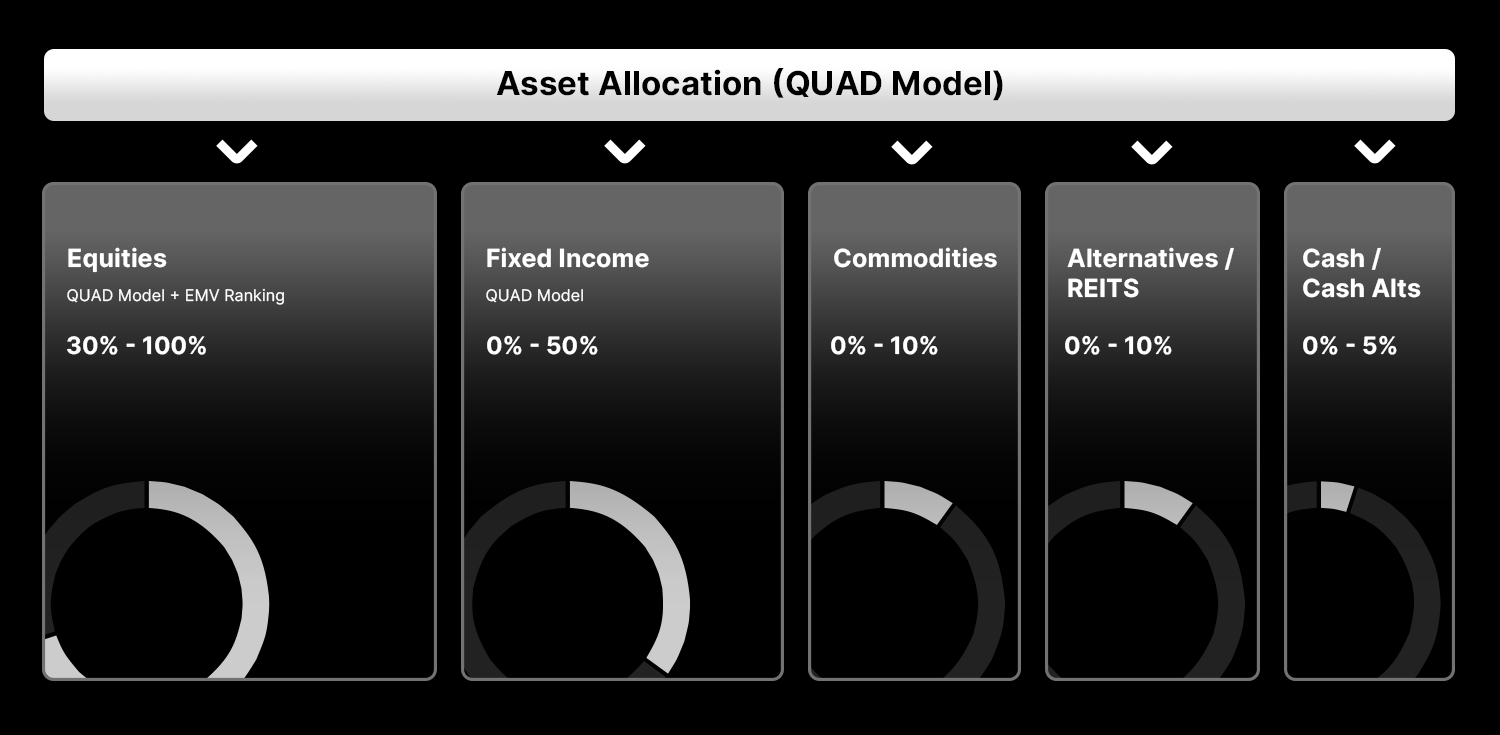

Each asset class has a general range we use in our portfolio construction, guided by our four quadrant model. To account for each client's differing profiles and risk tolerances, we set set caps on the various asset buckets in each of our strategies to ensure we have an optimal portfolio for each client's specific needs.