Q3 2024 Quarterly Update

IN REVIEW: 2024 Q3

The third quarter of 2024 stayed true to our “growing but slowing” theme, testing both investor optimism and market resilience. While the S&P 500 saw a solid 5.5% gain for the quarter, it faced some significant bouts of volatility along the way, dropping more than 5% during each pullback.

ECONOMICS

With inflation continuing to slow, the labor market took center stage in Q3. Indeed, the Federal Reserve has now pivoted to focusing on the latter part of its dual mandate – stable prices and maximum employment – as the labor market continues to cool. The Fed now projects unemployment to hit 4.4% by the end of this year, having risen from 3.7% at the end of 2023. Average monthly jobs growth for this year has been a more modest 184K/month average, compared to 251K in 2023 and 377K in 2022.

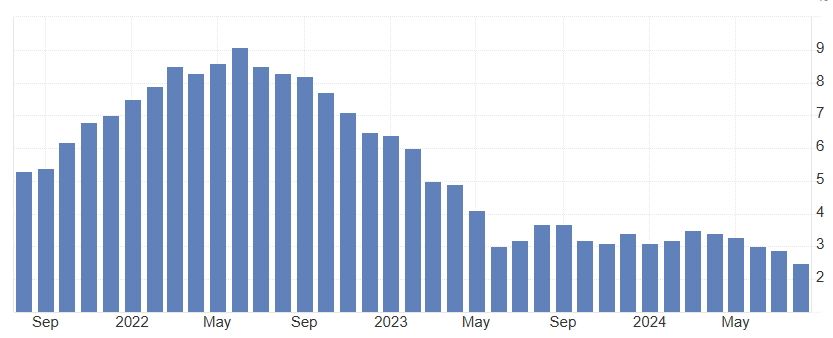

Inflation, as noted, has moved significantly in the direction of the Fed’s target. This was anticipated alongside further economic weakness. CPI is running at 2.5% year-over-year, and 2.0% on a 6-month annualized basis. PCE, the preferred inflation gauge for the Fed, is even a bit lower.

CPI Year-Over-Year (% Change)

Source: BLS, Trading Economics

GDP growth for the second quarter was a welcome surprise in strength. Initial forecasts in the 1-2% range gave way to the final 3% growth number. However, GDP estimates going forward continue to weaken, with 2.5% growth expected for Q4, and 2.0% annual growth anticipated in 2025.

Consumers, meanwhile, are still spending – albeit less so than last year. Retail sales numbers are hovering around 2% growth year-over-year, lower than their 3-5% range during 2023. Moderating wage growth and an uptick in unemployment have helped bring spending down, in addition to sustained higher prices. Importantly, though, consumers continue to have strong overall balance sheets, with historically low debt service ratios. All told, conditions still resemble the “growing but slowing” theme.

To close the quarter, the Fed commenced what it anticipates to be a series of interest rate cuts. Rates were reduced by 0.5%, bringing them down to 5.0%. Having seen sufficient progress on the inflation front, the Fed thought it prudent to begin normalizing policy given the slowing economic picture. This move was cheered by markets.

FINANCIAL MARKETS

As we continue to downshift in the economy, markets have been more volatile – reacting, sometimes violently, to incoming economic data surprises. However, markets were largely buoyed by “Goldilocks” type conditions – low inflation with modest economic growth. The anticipation and actual start of a Fed cutting cycle further helped support markets. This was particularly helpful for rate sensitive sectors – leading to outperformance in REITs, Financials, and Utilities (which have also gotten a boost from AI). Technology, meanwhile, took a bit of a breather after leading the markets YTD.

Earnings continue to be robust. Final numbers for Q2 earnings reflected year-over-year growth of 11.3%, besting the 8.9% estimated at the start of earnings season. The Healthcare sector posted among the biggest upside earnings surprises for Q2. LLY, for example (our biggest exposure in healthcare), beat already-lofty earnings growth expectations by over 40%. 2025 earnings growth estimates, meanwhile, have continued to rise – they currently sit at 15.2%. Healthcare and Technology sectors lead this charge, both with earnings growth expectations over 20%.

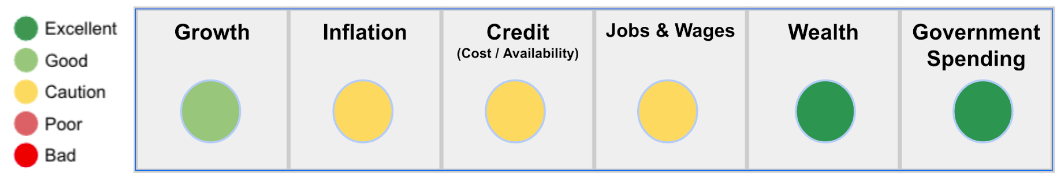

CURRENT CONDITIONS

As we progressed through Q3, we continued to observe a delicate balance between inflationary pressures and economic deceleration. Three key indicators are now signaling caution, with jobs and wages being the most recent to show warning signs. The unemployment rate has risen nearly 1% from its low of 3.4%, and historically, this type of increase has always preceded at least a mild recession. The long-term momentum in growth, employment, and credit is weakening.

WHAT’S AHEAD

Near – Medium Term (3-6 Months)

With economic data still showing modest strength and muted inflation, we anticipate equity markets will likely climb the wall of worry and continue to benefit from a “Goldilocks” scenario. As long as corporate earnings continue to deliver at expected levels and geopolitical tensions do not escalate further, we expect a rally into the year end. A supportive Fed only bolsters this outcome. Money could begin to leave short-term cash instruments as well as with rates falling – likely heading into equities.

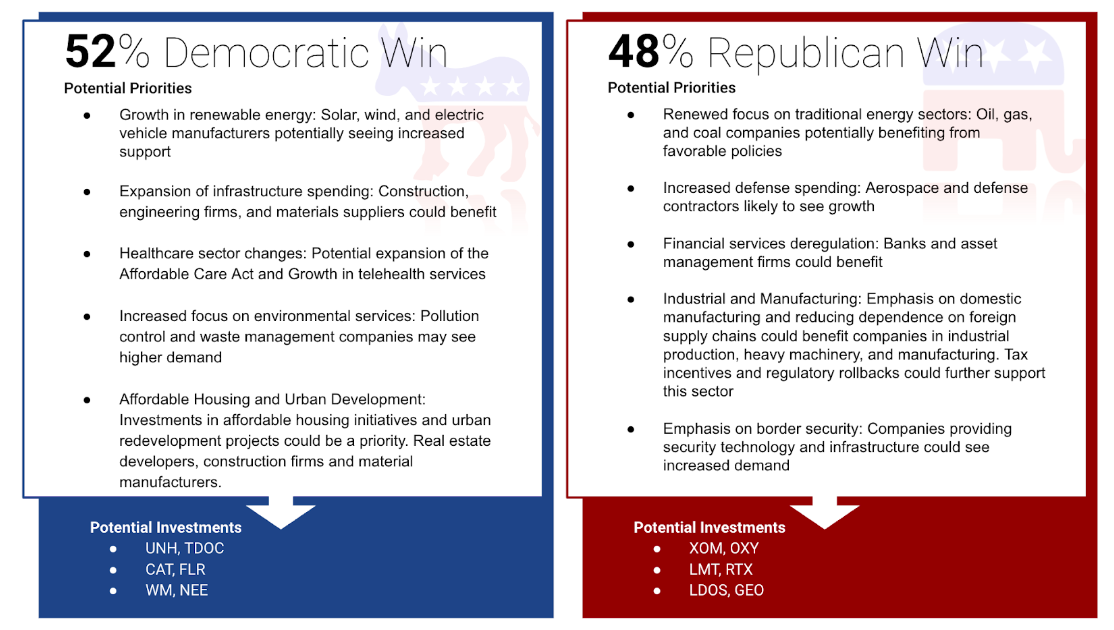

Election years typically see strong market performance following the actual election, regardless of party outcome. In particular, we see the highest likelihood of a divided congress – a scenario markets tend to appreciate, as dramatic changes to existing regulations are largely curtailed.

Longer Term (6+ Months)

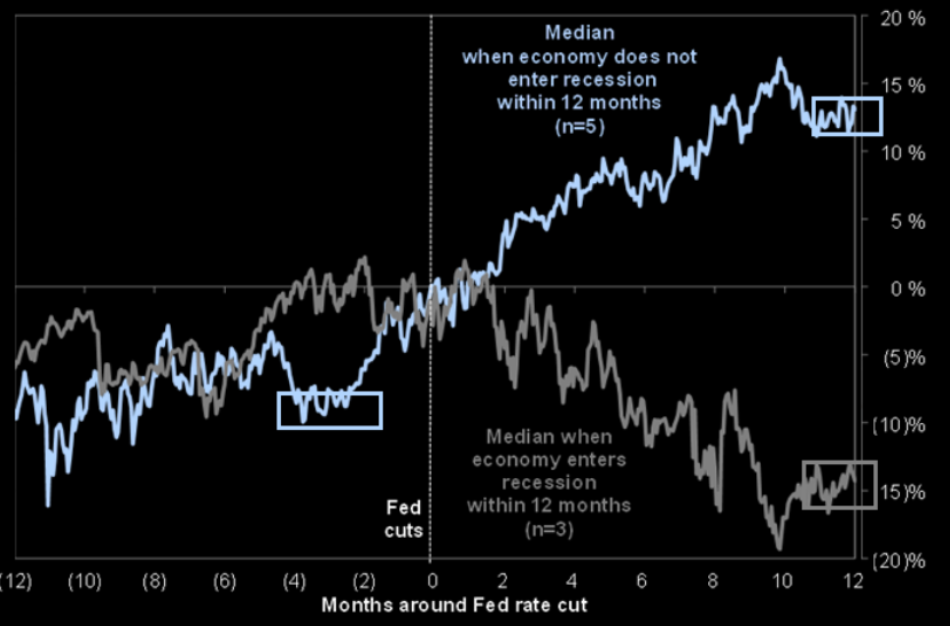

In the longer term, there are typically two distinct paths during a Fed cutting cycle – we either end up in a recession within the next year, or we avoid one. The following chart illustrates typical market performance in each of these scenarios.

12 Month Forward Market Performance After Fed Cuts – With and Without Recession

Source: Goldman Sachs

Given the still moderately strong economic conditions, it seems unlikely that we slip into recession within the next year. Perhaps a touch more likely is that Fed cuts reinvigorate economic conditions – and potentially bring higher inflation along with it. The Fed will continue to need to strike a delicate balance between supporting labor markets and keeping inflation near target. This will likely be incrementally more difficult with both political candidates not overly concerned with running up deficits. All things considered, we see enough economic strength down the pipeline to likely support higher equity markets over the next 6-12 months.

Of course, risk factors remain on the horizon – geopolitical tensions, a political sweep and dramatic policy shifts, even reignited inflation. Should any of these areas present more material concerns, equity markets could falter. These outcomes are somewhat less likely in our opinion.

ELECTION IMPACT

Since our last newsletter the Democratic party made the decision to swap out Joe Biden for Kamala Harris as the nominee in hopes of boosting their probabilities of winning the election. Based on current prediction / betting markets this was the right move for the party as Harris is now slightly ahead based on the latest data (see updated probabilities below). As we’ve previously discussed both parties have embraced running large deficits which tends to be positive for equity markets. However, deficit spending will find its way into different sectors/industries based on which party prevails.

Win % Chance (Based on PredictIt)

REASONS TO BE BULLISH

Global Rate Cuts: With inflation stabilizing, the Fed officially made their move to cut the federal funds rate by 0.50% bringing it down to 5%. The U.S. and many major central banks around the world are shifting their policies and forward guidance in a more dovish direction, despite inflation remaining above target in their economies. If economic strength continues, this approach is likely to support and drive valuations higher.

Election year: Although the democratic candidate has changed since our last newsletter, we continue to believe both Harris and Trump are taking populism to the extreme. Promising subsidies, tax cuts, loan forgiveness and other federally run programs which boost government spending ends with stronger consumption. Equity markets embrace this with open arms.

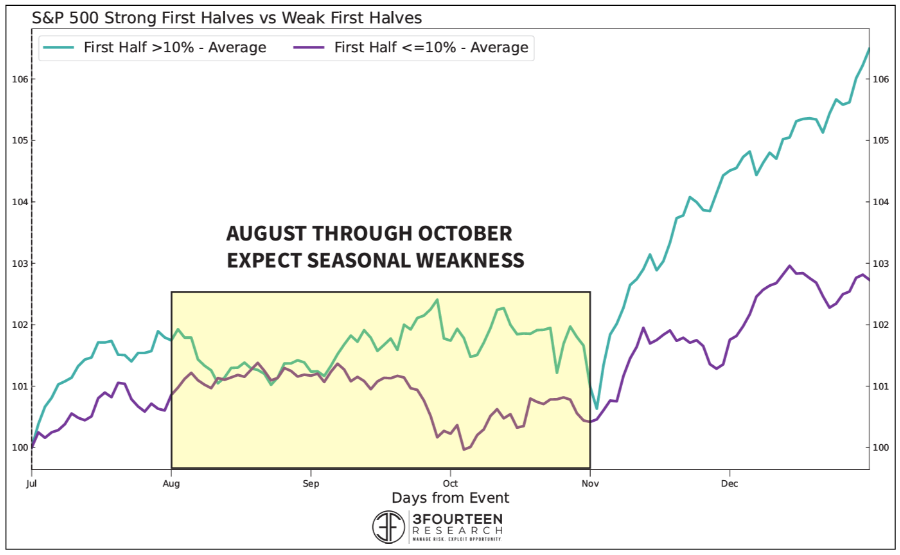

Seasonal Strength: Years where equity markets have strong first halves of the year lead to positive second halves (chart below). However, the August to October period which we are in now is quite choppy.

Seasonal Market Performance – With 1st Half Year Market Gains Above/Below 10%

Source: 3Fourteen Research

REASONS TO BE BEARISH

War: It’s clear geopolitical tensions are rising across the globe. A drawn out conflict between Russia and Ukraine along with an escalating situation between Israel and Iran / Hezbollah creates uncertainty which is difficult to navigate. In the event additional countries get pulled in or forced to choose sides there will be severe negative impacts to global markets.

Persistent Inflation Pressures: The Fed has decided to move forward with its rate cutting cycle while inflation is still above their target. Our view is they are erring on the side of letting the economy, and inflation, run hot rather than risk unemployment continuing to rise. Lower rates could cause an acceleration in both the economy and inflation, putting the Fed in a difficult situation if inflation expectations begin to rise beyond their control. Persistent higher inflation could erode consumer purchasing power and force the Fed to push interest rates higher for longer than markets anticipate, weighing on equity valuations.

Sluggish Global Growth: The global economy is showing signs of a broader slowdown, with key markets such as the Eurozone and China experiencing weaker-than-expected growth. This could dampen demand for U.S. exports and multinational corporate earnings, especially in cyclical industries like industrials and materials that rely on international markets for growth.

PORTFOLIO HIGHLIGHTS

One theme we have increasingly allocated to this year has been defense contractors. While the current geopolitical landscape is unfortunate, the defense industry has continued to stand out this year for obvious reasons. Growing geopolitical tensions and sustained government investment in military technology have benefited companies like Raytheon (RTX) who are front and center, leveraging their cutting-edge defense systems and aerospace innovations to meet the rising demand. With a solid pipeline of government contracts and a need to replenish depleted resources, Raytheon has carved out a strong position in a world where national security is an ever-growing concern.

In addition to Raytheon, the broader defense industry is seeing momentum, as reflected by the Aerospace & Defense ETF (ITA), which provides exposure to a range of leading defense contractors. The fund has shown resilience amid broader market volatility, benefiting from the sector’s stable and growing defense budgets. As geopolitical risks persist, and innovation in military technology advances, we expect defense companies to remain an attractive investment opportunity.

CLOSING THOUGHTS

As we move into the final quarter of 2024, we remain cautiously optimistic about the markets, despite ongoing economic challenges. The “growing but slowing” environment continues with inflation stabilizing though still above target, and economic growth decelerating. While equity markets have shown resilience, particularly in high quality companies and AI related industries, we must be mindful of elevated risks from concentrated stock performance and potential earnings downgrades.

As we approach the U.S. presidential election, we anticipate heightened volatility in the markets. However, historical data suggests that election years often lead to market gains regardless of the outcome, keeping us optimistic through year end. Our strategy remains flexible and adaptive and prepared to adjust should significant shifts in economic conditions or geopolitical risks emerge.