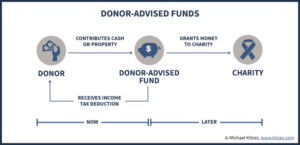

The Donor-Advised Fund

Many of our clients find themselves reflecting on their charitable goals while also considering strategies to optimize their tax positions before year-end. For those looking to accomplish both goals seamlessly, donor-advised funds (DAFs) can be a powerful tool. Let’s explore how DAFs can help you reduce taxable income and provide flexibility in your charitable giving.

WHAT IS A DONOR-ADVISED FUND?

A donor-advised fund is a charitable investment account that allows you to contribute assets, receive an immediate tax deduction, and recommend grants to your favorite charities over time. DAFs offer a streamlined way to support causes you care about without needing to decide immediately where your donations will go. Your investment advisor can manage these charitable assets for you in your DAF account, helping them grow until such time as you make grants in the future.

TAX BENEFITS OF DONOR-ADVISED FUNDS

One of the most compelling features of a DAF is the ability to make a large charitable contribution in a single year, which can provide a significant tax deduction. Here’s how:

• Immediate Tax Deduction: Contributions to a DAF are tax-deductible in the year they are made. This can be especially valuable in high-income years or when you anticipate a significant taxable event, such as the sale of a business or a large bonus.

• Avoid Capital Gains Tax: If you contribute appreciated securities, you can avoid paying capital gains taxes on the appreciation, while still receiving a deduction for the full fair market value. Moreover, any gains within the DAF are tax-free.

• Bunching Deductions: With the standard deduction now higher, many individuals find it challenging to itemize deductions annually. By “bunching” several years’ worth of charitable contributions into one year via a DAF, you can exceed the standard deduction threshold and maximize your tax benefit.

FLEXIBILITY IN CHARITABLE GIVING

Another advantage of a DAF is the flexibility it provides in deciding how and when to direct your charitable dollars. Once funded, you can:

• Take your time selecting charities that align with your values and goals.

• Distribute grants to charities over multiple years, even if the initial contribution to the DAF occurred in a single tax year.

• Adjust your giving strategy as your philanthropic priorities evolve.

This flexibility makes DAFs especially appealing if you know you want to give but are still determining the specific charities or causes you’d like to support.

IS A DONOR-ADVISED FUND RIGHT FOR YOU?

While DAFs are a valuable tool, they aren’t for everyone. Here are some factors to consider:

• Income Level: If you’re in a high-income bracket or experiencing a windfall year, a DAF can help you offset your taxable income significantly.

• Philanthropic Intentions: If you’re committed to charitable giving but prefer a more structured, long-term approach, a DAF offers the perfect balance of simplicity and control.

• Investment Growth: Contributions to a DAF can be invested and grow tax-free, potentially increasing the amount you’re able to give over time.

At DePaolo & May Strategic Wealth, we’re here to help you navigate the complexities of charitable giving and tax planning. If you’d like to learn more about donor-advised funds or explore other strategies to achieve your philanthropic and financial goals, don’t hesitate to reach out.