Q1 2025 Quarterly Update

IN REVIEW: 2025 Q1

With Trump’s policy agenda taking the main stage this quarter, our US Resilience theme is being tested. Investors attempted to digest a mix of positive earnings, persistent inflation concerns, and the early stages of the administration’s policy – which many view as a manufactured slowdown. Volatility returned as uncertainty increased across global trade, inflation and consumption.

TARIFFS

Tariffs have been front and center this year. Trump’s back-and-forth policy messaging kept investors on edge leading up to his so-called “Liberation Day.” So far investors have firmly repudiated Trump’s Liberation Day tariffs. It’s hard to make a good economic argument for tariffs on the scale Trump has contemplated. While tariffs for national security and some domestic production reasons can be reasonable, Trump’s Liberation Day actions target far more than tariffs – they target the trade imbalances between the US and other countries. Trade imbalances are often the natural result of country specialization and unique local conditions. Using policy actions to attempt to negotiate tariffs to zero between countries makes sense, but eliminating and/or penalizing trade imbalances via tariffs less so. Numerous officials on both sides of the political aisle have discussed plans to moderate the stated tariffs, going so far as to potentially block the administration’s ability to levy any tariffs without Congressional approval. Even Musk has come out in support of zero tariffs – in particular between Europe and the US. While painful, this wound has been entirely self-inflicted – we are optimistic that reasonable heads will prevail under enough pressure.

ECONOMICS

U.S. GDP growth remains positive, albeit decelerating. After a strong 2024, first quarter GDP forecasts are wide ranging amid rapidly shifting sentiment and policy. Consensus expects Q1 GDP to be slightly positive at 0.9%. Widely discussed negative forecasts are skewed by increased imports ahead of Trump’s tariffs, which detract from GDP and lead to an outlier one-time negative result. The labor market remains healthy, with unemployment stable around 4.2%, but wage gains having cooled.

Inflation remains somewhat sticky, especially in services. Some relief is finally coming on the housing side, and services could be poised to cool alongside softening wage growth. Headline PCE is closing in on the Fed’s target, with the most recent reading coming in at 2.5%. Market-based measures of inflation expectations have been volatile, however, contributing to the Fed’s continued cautious tone. Liberation Day tariffs threaten to bolster inflation in the near term, even if the result is more one-time rather than persistent in nature.

FINANCIAL MARKETS

The S&P 500 fell 4.6% in Q1, its worst quarterly performance since 2022. The Magnificent 7 tech giants (Apple, Nvidia, etc.) plunged 16% on average. Value sectors (energy, healthcare) outperformed growth, reversing 2023/4 trends – not uncommon in a risk-off environment. The Magnificent 7 now trade at the lowest valuation premium to the remaining S&P companies in 7 years. Should current concerns abate, there is likely significant upside for the prior market leaders.

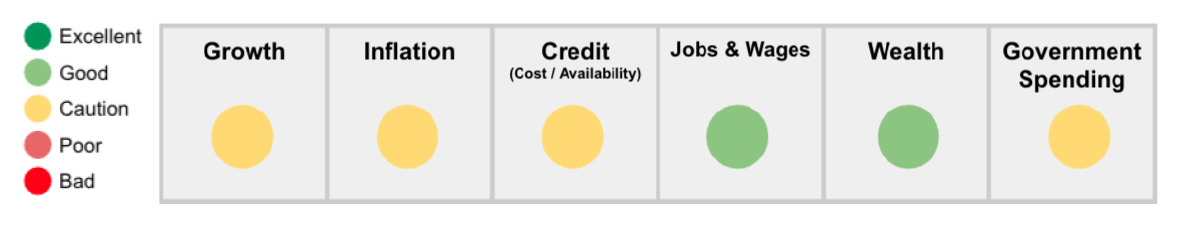

CURRENT CONDITIONS

Of our firm’s six primary indicators, four are flashing yellow. Consumer spending, while still positive, is beginning to soften—especially in discretionary categories. On the business side, capital expenditures remain healthy in select sectors (especially AI and automation), but recent tariff announcements may create a headwind to this moving forward. The recent decrease in rates should slightly ease financial conditions, increasing activity in rate-sensitive sectors like housing and commercial real estate. Jobs & wages continue to stay resilient through this period though we are hyper aware cracks may be starting with increased economic uncertainty. Credit spreads meanwhile remain historically tight, reflecting what investors view as a still-low risk of corporate disruption/insolvency.

The Fed’s posture remains cautious but not alarmed, signaling that while rate cuts are likely this year, they will come gradually and only if inflation trends warrant. Meanwhile, Trump and equity markets are signaling the time to cut is now.

WHAT’S AHEAD

NEAR TERM (3-6 MONTHS)

Tariff policy remains front and center. We anticipate continued market volatility, as headline-driven risks persist in both directions. In our view, we are currently in a period of peak uncertainty – one where heightened volatility can often trigger short-term market rebounds. However, for any rally to be sustained, it will require clarity on trade policy and a meaningful shift in investor sentiment. Recent fluctuations illustrate this dynamic—markets initially rallied on reports of moderated tariffs, only to reverse course as tariff details emerged, bringing stocks back to new lows on the year. With earnings season set to begin in mid-April, we’re cautious that some companies may take this opportunity to lower or even withhold forward guidance. If so, markets may react negatively, potentially leading to additional downside. The silver lining, however, is that these policy decisions are not set in stone – unlike war or natural disasters, they can be reversed or significantly altered with relative ease.

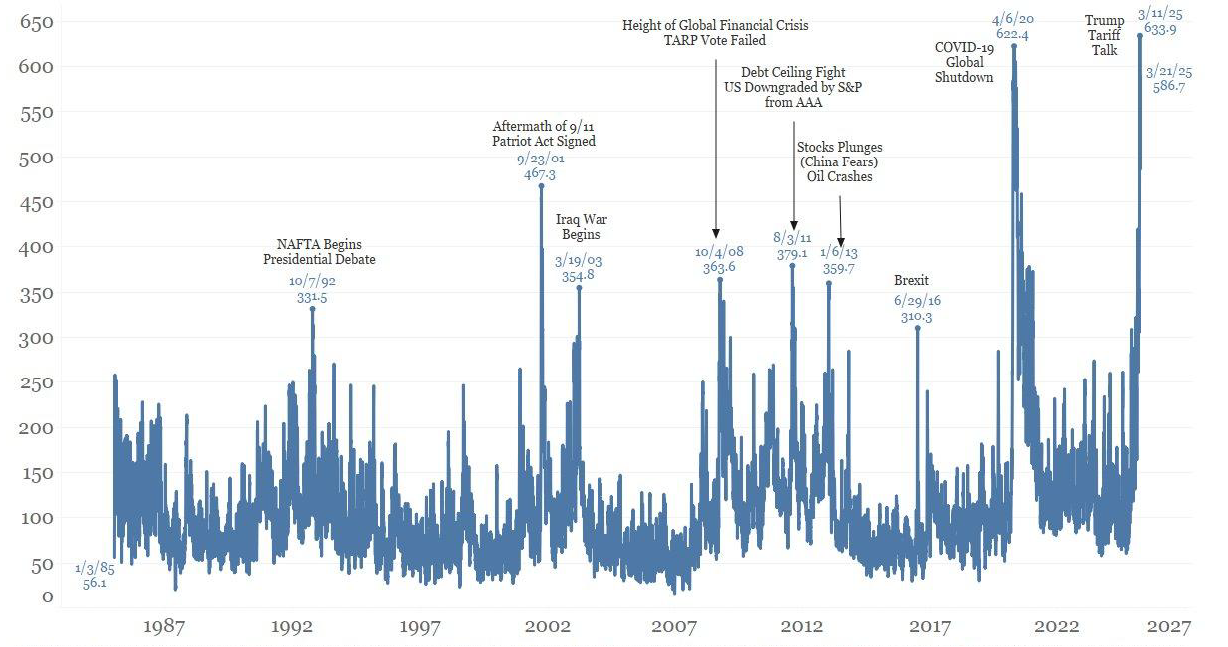

US Policy Uncertainty Index

Source: Bianco Research

Taking a look at the current economic data, a stark divide has emerged between the “soft” data, such as surveys of CEOs, consumers, and small businesses that signal recessionary fears, and “hard” data, including robust job numbers and initial claims, which suggest economic resilience. This contrast presents us two competing narratives – either markets are overly pessimistic, creating a compelling buying opportunity, (particularly in the most beaten-down market segments), or the risk remains too high given the uncertainties. Those with longer investment horizons should generally view it as the former, while those with the opposite the latter. These views, along with risk tolerance, are reflected in the strategy(ies) to which you are allocated. Keep in mind that the market typically rewards risk-taking over time – this is the value proposition of stocks in general. *View our strategies HERE

LONGER TERM (6+ MONTHS)

As we look further into 2025, the market’s path will be shaped by four key factors: Trump’s evolving trade policies, growth, inflation, and the Fed’s actions.

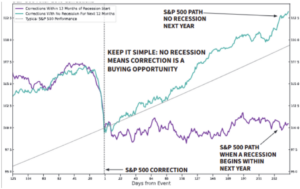

The administration has implemented new import tariffs across the globe. Trump is laser focused on his America First agenda. These measures may offer political and strategic appeal, but they undoubtedly create risks to growth and inflation. Should tariffs stay in their existing form, we expect negative downstream impacts on supply chains, consumer prices, and corporate margins – especially in manufacturing and retail sectors. If these ultimately lead us to a recession, investors who de-risked prior to the correction were right to do so as we can expect flat to down performance post the decline (see chart below). While these policies are receiving a lot of pushback, the administration has an optimistic outlook.

S&P 500 After 10% Corrections

Source: 3Fourteen Research

Trump’s policies aimed at reshoring manufacturing, tightening immigration, de-regulating and lowering taxes are pro-growth measures designed to strengthen the U.S. economy. Bringing manufacturing back home boosts domestic job creation and reduces reliance on foreign supply chains, enhancing economic resilience. Stricter immigration policies, while controversial, are intended to protect wages and ensure that job opportunities prioritize American workers. Meanwhile, de-regulation reduces bureaucratic red tape, making it easier for businesses to expand, innovate, and compete globally. Lowering taxes puts more money in the hands of consumers and businesses alike, encouraging spending, investment, and entrepreneurship—all key drivers of sustained economic growth which would keep us from seeing a recession. Together, these policies aim to build a more self-sufficient, competitive, and secure economic foundation for the U.S. where the longer term outlook is a positive environment for equities.

The inflation story also remains central. While headline numbers have cooled from their peaks, progress has slowed. Should inflation resume a steady decline toward the Fed’s 2% target, it would pave the way for more meaningful rate cuts later in the year—supporting both equity and fixed income markets. However, if inflation remains stubborn or re-accelerates, we could see a more defensive Fed, renewed market volatility, and tighter financial conditions.

In the case we tip toward recession, however, it’s unlikely inflation will remain sticky enough to keep the Fed on the sidelines. With rates still the highest they’ve been in years, the Fed has ample ammunition to step in and support a struggling economy. In fact, the current conditions are quite similar to 2018. In late 2018, sluggish growth under the weight of trade policy and the Fed having raised rates caused markets to stumble, only to see the Fed swoop in and engineer a swift resurgence in markets amid rate cuts.

Overall, while the U.S. continues to display economic resilience, the interplay between our four key factors stated above will be critical in determining whether markets find renewed tailwinds – or face renewed headwinds – into the second half of the year.

REASONS TO BE BULLISH

Pro-Growth Policy: Pro-growth policies – like tax cuts, private capital investment, and deregulation – can lift corporate profits and investor sentiment, supporting equity markets. These measures tend to stimulate economic activity, drive earnings growth, and reduce uncertainty around the business environment. When markets anticipate stronger GDP growth, equity valuations often expand in response.

Global Rate Cuts: A global shift toward rate cuts can be a strong tailwind for risk assets. Lower rates reduce financing costs and boost valuations, especially for equities and credit. As yields on safe assets fall, investors are often pushed toward riskier investments, fueling demand.. The key, however, is that rate cuts are seen as preemptive rather than reactive to a sharp slowdown.

REASONS TO BE BEARISH

Global Debt Refinancing Pocket: A record wave of global debt – both sovereign and corporate – is maturing over the next 1–3 years, creating a substantial refinancing pocket. This surge, driven by post-pandemic borrowing and years of low interest rates, now collides with a higher-rate environment. Governments and companies face rising rollover costs, putting pressure on fiscal budgets and corporate margins.

Global Trade: Recent implementation of sweeping tariffs has significantly disrupted global trade dynamics. These protectionist measures are prompting countries to reassess their trade relationships and supply chains, potentially leading to a reshuffling of global trade alliances. Such policies could increase consumer prices, slow economic growth, and elevate the risk of a global recession.

PORTFOLIO HIGHLIGHTS

In equities, while the broader tech sector has come under immense pressure amid positioning, uncertainty and multiple compression, our more defensive equity holdings have held up well. Notably, Berkshire Hathaway (BRK.B) and United Healthcare (UNH) have significantly outperformed in this environment, reflecting their high-quality and defensive attributes. These are both our highest-weight holdings in their respective sectors.

Our alternatives sleeve – which has grown to represent a more meaningful portion of client portfolios in both our Enhanced Growth and Enhanced Income strategies – continues to generate positive momentum with one of our largest positions BUCK making new all-time highs. This sleeve remains a standout performer and exemplifies our focus on uncorrelated, absolute return opportunities.

On the fixed income side we initiated our IEF (7–10 year Treasury exposure) position the first week of February, strategically adding duration at a time when we saw concerns around economic growth. The move has already proven beneficial—IEF’s duration has acted as an effective hedge against recent equity market volatility, helping to offset volatility in other holdings. (Note that these alternative and fixed income sleeves aren’t applicable to our most aggressive strategy).

CLOSING THOUGHTS

Q1 reminded us that the path forward will not be linear. Policy is a wild card, inflation is proving stubborn and market leadership is evolving. But we also see compelling opportunities – especially in innovative, quality companies. In light of recent market volatility, however, it’s important to keep context in mind – the last two years have seen standout back-to-back market performance.

We are continuously evaluating portfolio positioning across scenarios and adjusting as conditions evolve. Our approach remains disciplined and proactive.

Sincerely,

Kyle DePaolo & Dane May