Understanding Equity Compensation: ESPPs & RSUs

Equity compensation can be a powerful tool for building long-term wealth—but it comes with complexities that require thoughtful planning. Two of the most common forms of equity compensation are Employee Stock Purchase Plans (ESPPs) and Restricted Stock Units (RSUs). Each offers unique benefits and tax implications that can significantly impact your financial strategy.

ESPPs: A TAX EFFICIENT WAY TO BUY COMPANY STOCK

An ESPP allows employees to purchase company stock at a discount—often up to 15%—through payroll deductions. Qualified ESPPs (under IRS Section 423) offer favorable tax treatment if specific holding requirements are met.

HOW DOES AN ESPP WORK?

- Enroll in the plan: Once enrolled, you’ll be eligible to participate in the upcoming offering period. You’ll need to choose how much you want to come out of your paycheck to buy company stock. Contributions are capped at $25,000 annually (fair market value of stock, not any discounted value).

- Set aside money each month: Within an offering period, your contributions from each paycheck (post-tax) are set aside to purchase company stock at the purchase date.

- Stock is purchased: Typically at the end of the purchase period (i.e. purchase date), your accumulated contributions are used to purchase the stock at an agreed discount (if any).

- Sell the stock: You can sell your ESPP stock right after you purchase it (“Quick Sale”) or hold onto it to sell at a future date in the hopes it will increase in value and to potentially accrue tax benefits.

TERMS ASSOCIATED WITH ESPPs

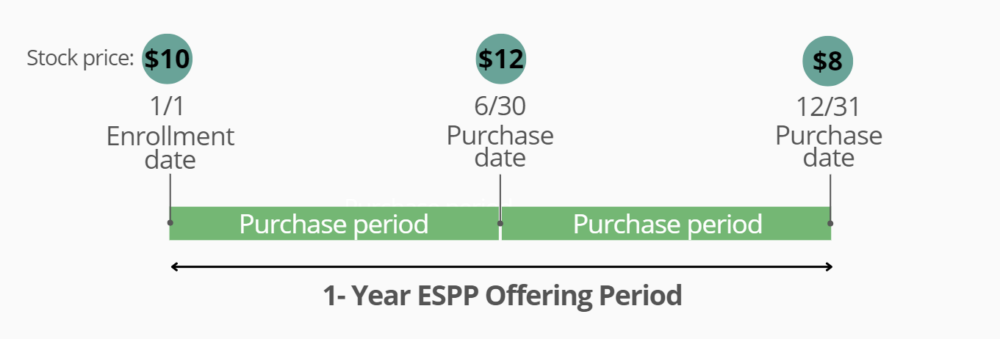

- Offering period: The period of time during which you can purchase company stock at an agreed discount (if any). In the example below, it’s a 12-month offering period.

- Enrollment date: The date that you enroll in the plan, e.g. Jan 1 in this example.

- Purchase period: Within an offering period, there can be a series of purchase periods in which you set aside money to purchase the stock. In this example, there are 2 purchase periods.

- Purchase date: The date on which shares are purchased, i.e. Jun 30 and Dec 31 in this case.

- Purchase price: The price at which shares are purchased by you. This occurs on the purchase date.

ESPPs WITH LOOKBACKS

An ESPP lookback feature allows the ESPP discount to be applied to the lower of two prices: either the stock price on the enrollment date (Jan 1) or the price on the purchase date (Jun 30). This is an excellent feature that aims to maximize the benefit to the employee.

TAX TREATMENT: QUALIFYING VS. DISQUALIFYING DISPOSITIONS (SALES)

The tax implications of ESPPs depend on how long you hold the shares after purchase at the time of sale:

- Qualifying Disposition: Held for at least 1 year after purchase and 2 years after the start of the offering period.

-

- Ordinary income is recognized on the lesser of the discount or the gain between the purchase price and the market price at the time of purchase.

-

- Any additional gain is taxed as a long-term capital gain.

- Disqualifying Disposition: Sold before meeting the Qualifying Disposition holding length requirements.

-

- The difference between the stock price on the date you purchased the ESPP shares and the price you actually paid is taxed as ordinary income.

-

- Any additional gain is taxed as a short-term or long-term capital gain, depending on the holding period.

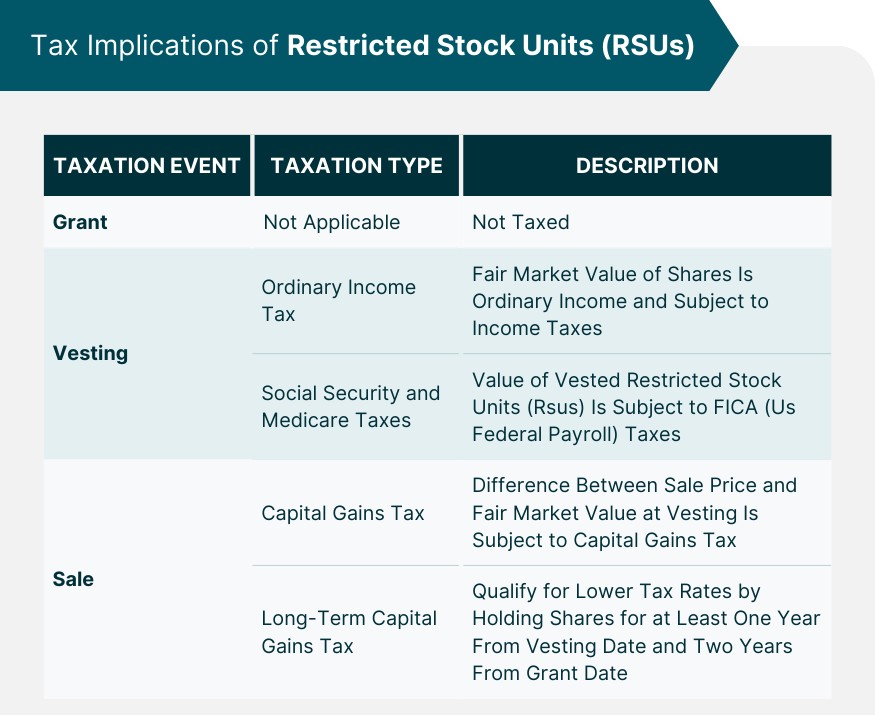

RSUs: SIMPLER TO UNDERSTAND, BUT NOT WITHOUT NUANCE

RSUs are company shares granted to employees, typically vesting over a set period. Unlike stock options, RSUs don’t require you to purchase the shares—they are delivered to you upon vesting.

STRATEGIC CONSIDERATIONS

Both ESPPs and RSUs can be valuable components of your compensation and investment strategy. Understanding their tax implications and aligning them with your financial goals is crucial.

ESPPs

- Ideal for employees seeking to purchase company stock at a discount and willing to hold the shares to benefit from favorable tax treatment.

- Alternatively, ESPPs can be useful for selling immediately (a “Quick Sale”) and realizing the gain from discount – effectively a salary bump (your wages of, say, $85 were used to purchase $100 worth of stock…an ~18% salary increase on ESPP funds when viewed this way).

- From a planning perspective, it’s important to not be overly leveraged to your employer – salary, stock, etc – be strategic when considering the size/duration of ESPP holdings.

RSUs

- Provide a straightforward benefit but require careful tax planning upon vesting to avoid unexpected liabilities.

For personalized guidance on managing your equity compensation, feel free to reach out to our team at DePaolo & May Strategic Wealth.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Investments in securities involve the risk of loss. Clients of DePaolo & May Strategic Wealth may hold positions in the securities discussed in this content. Please see disclosures here: https://dmstrategicwealth.com/disclosures