The Debt Refinancing Wall Ahead: What the Next Few Years Mean for Investors

As we move through 2025 and beyond, headlines continue to highlight a key theme that has quietly been building since the low-rate era of 2020–2021: debt refinancing. Both the U.S. government and corporations are entering a period of massive refinancing needs. For investors, the implications are wide-ranging, from interest rate pressures to market volatility.

WHY THE NEXT FEW YEARS MATTER

During the pandemic, both public and private entities took advantage of historically low interest rates to issue large amounts of debt. Fast forward to today, and much of that debt is coming due—right when interest rates are significantly higher.

For U.S. corporations, this means higher costs to refinance existing obligations, potentially impacting margins or even business viability. Meanwhile, the federal government is issuing hundreds of billions in new debt to cover budget shortfalls and roll over maturing Treasurys. All this debt must find a home, and that demand for capital will impact everything from bond yields to equity valuations.

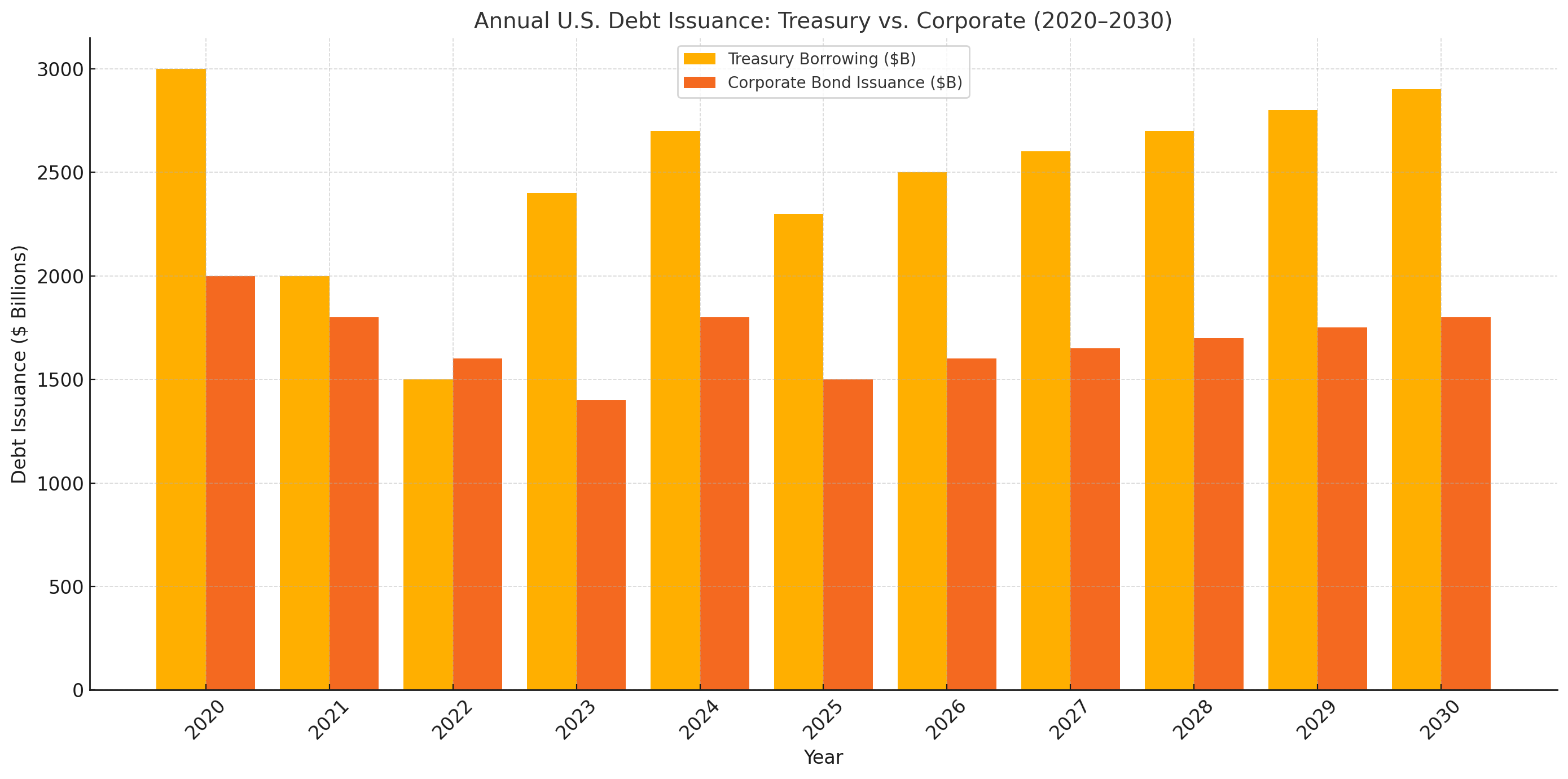

HOW BIG IS THE WALL OF DEBT?

To put the magnitude in perspective, here’s a breakdown of annual debt issuance going back to 2020 (data table and visualization below):

| Year | Treasury Net Marketable Borrowing ($B) | Corporate Bond Issuance ($B) | Combined Total ($B) | Notable Context |

|---|---|---|---|---|

| 2020 | ~3,000 | ~2,000 | ~5,000 | COVID-19 pandemic response |

| 2021 | ~2,000 | ~1,800 | ~3,800 | Continued pandemic support |

| 2022 | ~1,500 | ~1,600 | ~3,100 | Economic reopening |

| 2023 | ~2,400 | ~1,400 | ~3,800 | Inflation concerns emerge |

| 2024 | ~2,700 | ~1,800 | ~4,500 | Interest rate hikes |

| 2025* | ~2,300 | ~1,500 | ~3,800 | Refinancing wave anticipated |

| 2026* | ~2,500 | ~1,600 | ~4,100 | Ongoing fiscal pressure |

| 2027* | ~2,600 | ~1,650 | ~4,250 | Rising interest expense |

| 2028* | ~2,700 | ~1,700 | ~4,400 | Peak in maturing corporate debt |

| 2029* | ~2,800 | ~1,750 | ~4,550 | Treasury debt refinancing surge |

| 2030* | ~2,900 | ~1,800 | ~4,700 | Continued elevated issuance |

*Figures for 2025–2030 are projections based on current estimates.

WHAT’S AT STAKE

The risk isn’t just for corporations with weak credit. Higher Treasury issuance competes directly with corporate borrowers for capital. When the U.S. government floods the market with bonds, it can drive yields higher across the board. That means higher financing costs not just for companies but for mortgages, auto loans, and other forms of credit.

In sectors like commercial real estate, where hundreds of billions of debt is maturing in the next 18 months, refinancing may prove particularly difficult. And in speculative-grade corporate credit, many companies that thrived on cheap borrowing could now face margin compression or even default risk.

HOW WE’RE THINKING ABOUT IT

Given the scale of upcoming refinancing across both government and corporate markets, we’re continuing to take a cautious stance on bonds as we have since the 2020 fiscal deficit blow out. We are hesitant to allocate any meaningful capital to fixed income with a duration of over 2 years. We will however, continue to leverage t-bills in certain strategies to capture 4-5% risk free returns with minimal volatility.

Unless there is a clear deterioration in economic growth or labor markets that prompts a pivot from the Federal Reserve, we expect to remain underweight longer-duration fixed income. Instead, we’re focusing our efforts on our thematic equity opportunities, particularly in companies who will benefit from strong economic growth, sticky inflation, and the pricing power to navigate a higher-rate environment.