Trump’s Nuclear Pivot: A New Era for Energy and Investment

In a move to reshape America’s energy landscape, President Donald Trump has signed a series of executive orders aimed at revitalizing the U.S. nuclear industry. These directives not only streamline regulatory processes but also position nuclear power at the forefront of the nation’s strategy to meet surging electricity demands, particularly from sectors like artificial intelligence and defense.

KEY HIGHLIGHTS OF THE EXECUTIVE ORDER

Regulatory Overhaul

The Nuclear Regulatory Commission (NRC) is now mandated to decide on reactor licenses within 18 months, a significant reduction from previous timelines that often spanned several years.

Supply Chain Strengthening

Invoking the Defense Production Act, the orders aim to bolster domestic uranium mining and enrichment, reducing reliance on foreign sources, especially Russia and China.

Deployment of Advanced Reactors

The Department of Energy is directed to initiate construction of 10 large reactors by 2030 and support the deployment of small modular reactors (SMRs), which are seen as crucial for powering AI data centers and military installations.

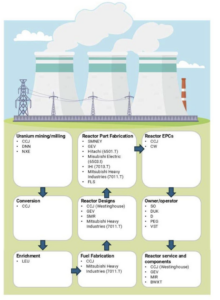

OVERVIEW OF COMPANIES IN THE NUCLEAR POWER SPACE

INVESTMENT OPPORTUNITIES

The financial markets have responded enthusiastically to these developments. Companies like Oklo, specializing in SMRs, saw their stock prices surge by over 150% in 2025 alone. Centrus Energy, the only U.S.-owned uranium enricher, also experienced significant gains, reflecting investor optimism about reduced foreign dependency.

Investment Opportunities:

For investors, this policy shift opens avenues in several areas:

SMR Developers

Companies like Oklo and NuScale Power are at the forefront of SMR technology, offering scalable solutions for modern energy needs.

Uranium Suppliers

With a focus on domestic enrichment, firms such as Centrus Energy and Cameco are poised to benefit from increased demand.

Infrastructure Providers

Companies involved in constructing and maintaining nuclear facilities stand to gain from the accelerated deployment plans. VST, one of our portfolio companies, is a great example in this category. VST had already been experiencing big tailwinds as an energy provider resulting from the AI boom, with more potential upside now stemming from its nuclear power division.

President Trump’s executive orders mark a significant turning point in U.S. energy policy, emphasizing nuclear power’s role in achieving energy independence and meeting future demands. For investors, this represents a timely opportunity to engage with a sector poised for substantial growth.