Q2 2025 Quarterly Update

IN REVIEW: 2025 Q2

There was no shortage of fireworks this quarter. Q2 marked the fastest recovery from a 15%+ drawdown in the history of the S&P 500 – a rare and powerful snapback fueled by shifting rhetoric out of the White House. As we anticipated, following escalating tariff threats, cooler heads prevailed. The Trump administration signaled a willingness to moderate its stance, particularly toward European and Asian allies, having used the reciprocal tariffs as merely the opening salvo for negotiations. That pivot reversed the tide in financial markets, helping risk assets rebound sharply. Geopolitics was similarly volatile. However, after significant military actions (including by US forces), there appears to be a de-escalation in the Middle East region.

Shortly after the end of the quarter, Trump passed his much-touted “Big Beautiful Bill.” The bill reflects a continuation of 2017 Trump-era tax policies, with an emphasis on business investment, small business relief, and limiting government expansion – as well as locking in tax cuts that were otherwise going to sunset. Beyond this, new provisions such as tax breaks for seniors, investment accounts for newborns, no taxes on tips and overtime, and more found their way into the bill. The bill should provide a strong fiscal impulse over the coming years, while providing no shortage of heartburn for debt hawks.

ECONOMICS

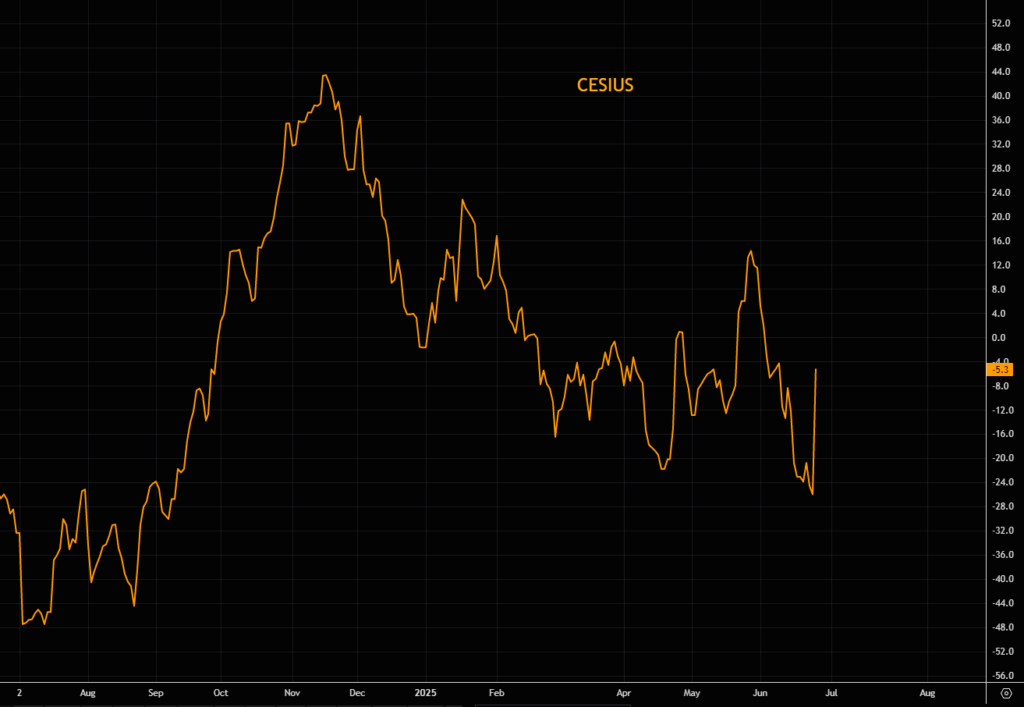

US Economic Surprise Index

Source: Citi / Bloomberg

The US economy surprised to the upside by the end of Q2. All-told, real-time GDP estimates from the Atlanta Fed suggest Q2 growth of approximately 2.6%, reflecting a still-strong economy and a continuation of our “US Resilience” theme. Recall too that Q1’s -0.5% “contraction” was due almost entirely to a pull-forward of imports from tariff uncertainty, which mathematically had a negative effect on GDP. Nearly all other categories – and most importantly, consumer spending – remained positive.

Other economic data was similarly constructive. Unemployment ticked down to 4.1% in June from 4.2% in May. Wage gains have moderated but remain above the rate of inflation. The Fed’s preferred inflation gauge, PCE, is still somewhat above target, stuck around 2.7% for several months now. However, on a quarterly annualized basis, PCE ran just a touch over 2.2% in Q2.

The Fed, meanwhile, has yet to lower the Federal fund rates – despite Trump’s vehement opposition. Concerns over the potential inflationary effects of tariffs, PCE still above target, and a relatively strong economy have provided the Fed with some cover for its position. However, economic growth has clearly been slowing, along with wage growth, and certain sectors – technology especially – have seen relatively high and rising levels of unemployment. The housing market remains largely at a standstill, and is typically one of the biggest drivers of the US economy. With Powell’s successor seemingly waiting in the wings for a transition next year, the market may be looking through Powell’s reluctance toward more rate cuts to come into 2026 under a new, more dovish Fed chair.

FINANCIAL MARKETS

Despite a roller-coaster ride of performance, the S&P 500 ended up modestly in Q2 – aided by strong performance in high-beta and momentum segments. Defensive and rate-sensitive sectors, on the other hand, lagged. NVIDIA (NVDA) and Microsoft (MSFT) hit new all-time highs, reflecting investor enthusiasm for AI and technology themes – some of our favorites. Fixed income returns were mixed to negative, as yields continued to be volatile amid sticky inflation, the Fed’s caution, and Trump’s fiscal agenda.

CURRENT CONDITIONS

Half of our indicators reflect good conditions, an uptick from last quarter. Unemployment remains relatively low after coming in better than expected in June. Wage growth, while moderating, remains firmly above inflation. And Trump’s recently passed “Big Beautiful Bill” should keep a strong fiscal backdrop in place, not to mention be a boon for both businesses and consumers.

Growth, meanwhile, has eased. While Trump’s new bill should spur near term growth, for now, the indicator remains cautionary. Inflation, likewise, remains stuck in the high 2%. The Fed’s continued pause on rate cuts has kept the credit markets somewhat locked up, and credit spreads widened mildly in June (while remaining historically tight).

WHAT’S AHEAD

NEAR TERM (3-6 MONTHS)

We expect a relatively quiet summer for financial markets, with volatility subdued and stocks continuing to climb the wall of worry. While Q2 earnings may spark isolated bouts of volatility, especially if margins disappoint, investors appear largely comfortable with the current macro backdrop. Any unilateral trade progress could also cause momentary reactions, but barring a major surprise, markets seem poised to remain lackadaisical through the summer months.

The bigger test may come in the fall. If the Federal Reserve still hasn’t delivered a rate cut and consumer strength continues to fade, a growth scare could trigger a more meaningful pullback in equities. That said, if markets weather that softness and earnings hold up, this likely sets the stage for a strong year-end rally, especially if equities hold their current gains heading into December.

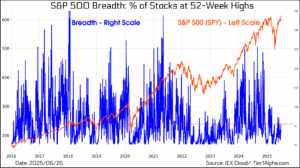

Trade remains a key wild card. While a recent deal with Vietnam provides a constructive signal, the real market-moving progress would come from deals with major partners like China, Mexico, Canada, or the EU. Broader agreements would help restore confidence in global supply chains and support risk sentiment. We also anticipate the performance gap between megacap tech and more cyclical sectors to narrow, particularly if investor optimism builds around the Trump administration’s expected fiscal push and eventual Fed easing. Market breadth is near recent lows – leadership may well be poised to broaden out under good conditions.

S&P 500 Breadth (Lower = Narrower Leadership)

Source: Tier1Alpha

LONGER TERM (6+ MONTHS)

Year 2 of a presidential term is historically weak, especially for new administrations. These years often see political friction, midterm elections, and the start of policy implementation friction. That backdrop may create added uncertainty for markets once into 2026.

We will have a new Fed chair in 2026, and they will almost certainly be easing. Combined with Trump’s recently passed fiscal bill, which could unlock delayed business investment and support growth if implemented effectively, these policy shifts have the potential to provide a meaningful boost to the economy. If both easing and fiscal support come through in a credible way, they could offset some of the typical headwinds seen in a presidential cycle’s second year and help markets continue to make new highs.

Additionally, earnings expectations will be critical. In 2025, estimates have remained relatively conservative, allowing companies to consistently outperform. If expectations for 2026 rise too quickly, companies could struggle to beat elevated targets, especially if economic momentum softens or margin pressures re-emerge.

We remain constructive on the long-term outlook. Corporate fundamentals are solid, innovation trends continue to advance, and eventual Fed easing should provide support. However, sticky inflation, political turbulence, and unresolved trade tensions could present meaningful challenges.

REASONS TO BE BULLISH

• Positioning Still Defensive: Investor positioning remains cautious, with many portfolios overweight cash, short-duration bonds, or underexposed to equities. If the macro backdrop stabilizes and/or the Fed pivots toward easing, this could trigger a near term re-risking cycle and fuel a continued broad market rally.

• Productivity Tailwinds: AI, automation, and digitization continue to boost productivity across sectors. As more industries adopt these technologies, especially laggards like manufacturing and logistics, margin expansion and stronger earnings growth could surprise to the upside.

• Coming Rate Cuts: There is a high probability of rate cuts over the next several quarters, particularly with a new Fed chair expected in 2026. Easing policy would lower the cost of capital, support valuations, and help cushion the economy against any late-cycle softness.

REASONS TO BE BEARISH

• Geopolitical Flashpoints: Rising tensions around Taiwan, further escalation in the Middle East, or a major cybersecurity incident could deliver a geopolitical shock that rattles risk assets globally. These events are low probability but high impact, and could trigger sharp risk-off moves in a relatively fragile market.

• Debt Refinancing Wall: A record volume of debt across sovereign, corporate, and commercial real estate markets is maturing over the next 12 to 18 months. Refinancing at much higher rates may strain balance sheets, increase default risks, and put sustained pressure on credit spreads and equity valuations.

• 2026 Policy Gridlock Risk: As mentioned above, year 2 of a presidential term is often marked by political friction and legislative gridlock. If consumption stalls heading into a slower-growth environment, investor sentiment could weaken just as the economy becomes more vulnerable.

PORTFOLIO HIGHLIGHTS

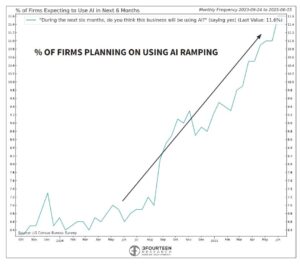

Our equity allocations have benefited from continued strength in the AI and software sector. Bellwether names like NVIDIA (NVDA) and Microsoft (MSFT) are trading near all-time highs and have been standout contributors to performance. These positions reflect our conviction in long-term innovation themes and their ability to compound through market cycles. While somewhat difficult to gauge, we still seem early in the AI adoption phase for many companies.

% of Firms Planning on Using AI in the Next 6 Months

Source: 3Fourteen Research

In contrast, our more defensive holdings such as Berkshire Hathaway (BRK.B) and United Healthcare (UNH) have lagged, reflecting the market’s current tilt toward growth over stability (as well as the drag from some company-specific issues). While these positions continue to serve as core holdings, we are actively evaluating their relative opportunity cost.

Our alternatives allocation continues to provide a stabilizing force within portfolios, helping mitigate volatility during periods of market stress. While these holdings are not at new highs, they continue to serve their purpose as a diversifier.

In fixed income, our small allocation in IEF (7–10 year Treasuries) remains intact. As growth continues to slow and the potential for rate cuts increases, our duration exposure provides balance and potential upside in the event of further equity volatility.

CLOSING THOUGHTS

The second quarter reinforced that we are in a period of transition, shaped by a changing political agenda and geopolitical risk. Markets continue to digest mixed signals, with pockets of strength and evolving risks.

Looking ahead, a quiet summer may give way to a growth scare in the fall if the Fed delays rate cuts and the consumer shows signs of fatigue. Still, with easing likely and supportive fiscal and tax policy beginning to take shape, conditions are in place for a strong finish to the year, especially if earnings remain solid. Markets also believe President Trump is responsive to both equity and fixed income market stress and may adjust course if conditions deteriorate, adding a layer of potential downside protection.

As always, our focus remains on growing and protecting your capital. When we see opportunities, we want to participate with conviction. When we believe risks are on the horizon, we will adjust accordingly.

Sincerely,

Kyle DePaolo & Dane May