Q3 2025 Quarterly Update

IN REVIEW: 2025 Q3

The third quarter extended our “U.S. Resilience” theme with moderation. Growth held up well despite incremental labor market deterioration. Equities posted solid returns, although leadership remains concentrated in larger companies. AI enthusiasm continued to power market gains, with some questioning whether or not we’re currently in an AI-driven bubble. We’ll get back to this topic in our forecast below.

ECONOMICS

In the final tally, Q2 GDP growth came in at 3.8%, besting initial estimates of 2.6%. GDP expectations for the third quarter are tracking at a similarly strong level, consistent with our “U.S. Resilience” theme. Robust consumer spending continues to anchor US growth – retail sales increased at a 5% annual rate in the most recent read. Inflation, meanwhile, remains stuck above the Fed’s target. PCE inflation readings, after having dipped mid-year, are now back around the same 3% level as late 2024. Tariffs may be resulting in part of this, although producer price data isn’t reflecting an obvious bump from tariffs, so the net effect remains unclear.

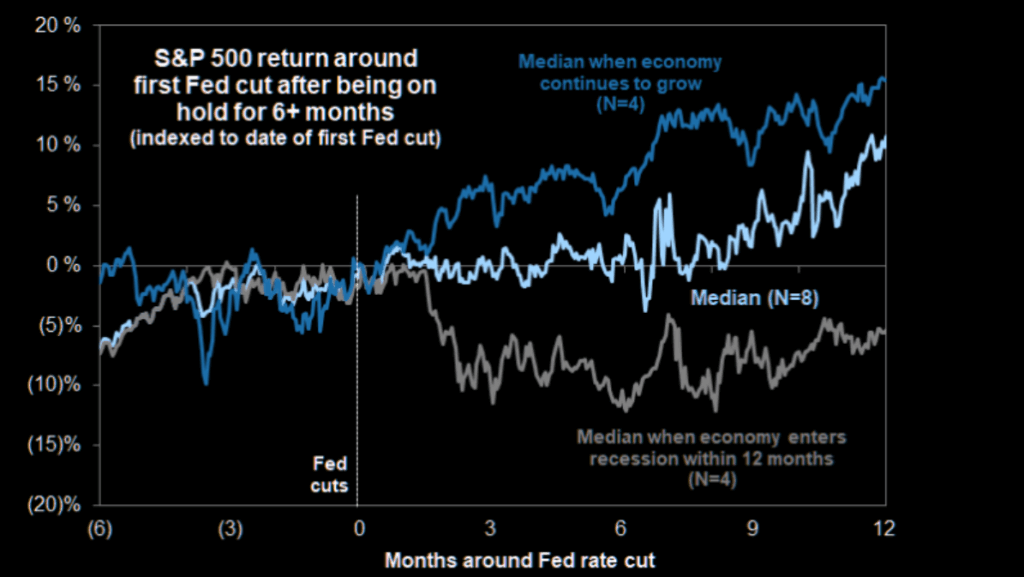

S&P 500 Performance – Fed Restarting Cuts – With or Without Recession

Source: Goldman Sachs

Even so, the Fed restarted its interest rate cuts during Q3, owing to a weakening labor market that gave them more concern than the modestly above-target inflation. Already skewing dovish in its composition, the Fed seems likely to continue this cutting campaign, with two more cuts widely anticipated this year. When Fed Chair Jerome Powell is ultimately replaced in 2026, further cuts will be all but assured. As seen in the chart above, market performance tends to be strong during the continuation of a rate-cutting cycle where we avoid a recession – similar to the conditions in place today.

FINANCIAL MARKETS

U.S. equities delivered healthy returns in the third quarter, with the S&P 500 gaining about 8%. Leadership came from technology, consumer discretionary, and communication services segments, with AI-names running well out in front. Consumer staples were the main laggard, as investors favored growth and economically sensitive segments over defensive names.

In the bond market, yields experienced choppy trading as investors continued to weigh inflation persistence against growth prospects. The 10-year Treasury moved in a wide range, at times responding sharply to macro releases and policy speculation. Markets remain sensitive to shifts in data and Fed expectations.

Gold continued its year-long rally without much hesitation. Above target inflation, moderate growth and a continued Fed cutting cycle were more than enough fuel to keep this fire going. We’ll discuss this more below as we touch on our “Debasement” theme.

CURRENT CONDITIONS

Our core indicators remain mostly consistent with last quarter, though one key shift has emerged. Growth surprised to the upside, supported by resilient consumer spending and substantial business investment. Inflation continues to ease gradually, and fiscal support remains a stabilizing force for both households and corporations.

The labor market, however, has softened at the margin. Rising unemployment and slower wage gains now signal caution, though part of that dynamic may stem from the ongoing decline in migration, which continues to tighten labor supply in key industries. Financial conditions remain supportive, with equities strong, credit spreads contained, and liquidity ample. Overall, the economy remains on stable footing even as the balance between growth and employment becomes more nuanced.

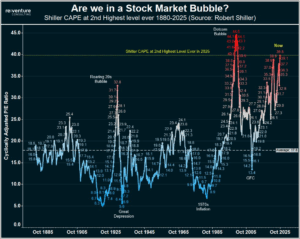

WHAT’S AHEAD: ARE WE IN A BUBBLE?

The question of whether markets are in a bubble has become unavoidable. It’s our view that we are likely in the early stages of one, as exuberance and liquidity continue to build across asset classes. There are clear similarities to the late 1990s in how quickly optimism has spread and how powerful the underlying story has become. Bubbles need narratives, and today’s AI narrative is as strong as any we have seen since the early internet. In both periods investors could sense that the world was changing but could not yet see the full destination.

Just as in past cycles, the current boom is being driven by massive investment built on expectations of future profitability. A key difference today, however, is that much of this spending is coming from companies with real earnings power and balance sheets strong enough to fund the build-out themselves. The current capex cycle is tangible, spanning power generation, grid expansion, semiconductors, networking, and industrial equipment. While that grounding lends more durability than the speculative excesses of prior booms, risks remain – and the eventual winners are far from certain.

Even so, early cycles nearly always overshoot. Build-outs can get ahead of demand, leadership can rotate multiple times, and valuations in the front-runners leave little room for error. For now, the AI story remains a powerful force driving both investment and imagination, and as with every great narrative-driven cycle, the challenge for us will be separating lasting innovation from short-term excess.

Shiller PE at Elevated Levels

Source: Re:Venture

NEAR TERM (3-6 MONTHS)

Policy remains a dominant influence on near-term market behavior. The administration’s fiscal posture and influence over the Federal Reserve have reinforced an environment of expanding liquidity and broadly accommodative conditions. Credit remains accessible, funding costs are stabilizing/improving, and the flow of capital into financial assets continues to gain momentum. S&P company earnings also remain strong – in fact, intra-quarter earnings revisions by analysts for Q3 were the best since the 4th quarter of 2021. For the full year, analysts raised S&P 500 earnings growth expectations from 9% to nearly 11%. This backdrop remains constructive for stocks as we head into year-end.

Seasonality amplifies this foundation. November and December have historically been favorable months for equities, driven by end-of-year positioning, portfolio rebalancing, and retirement-plan inflows. Condensed trading calendars and abundant liquidity often create a tailwind for risk assets as investors chase performance into year-end, particularly in years (like this) where markets have already moved substantially higher.

Earnings will be a key factor, with expectations still high after a year of resilient margins and limited room for disappointment. Altogether, with liquidity tailwinds, favorable seasonality, and steady earnings, we believe the setup into year-end presents meaningful upside for equities.

LONGER TERM (6+ MONTHS)

As we move into the new year, the potential for an air pocket in markets increases following a strong finish to 2025. If year-end enthusiasm drives valuations higher, the early months of 2026 could see a period of digestion or mild correction as liquidity normalizes and positioning resets. Some cooling would be healthy, helping to consolidate gains and rebuild a stronger base for the next advance. The market may need to recalibrate expectations as the effects of temporary liquidity support fade and investors refocus on fundamentals, earnings sustainability, and the policy path ahead.

Beyond that initial adjustment, we remain constructive on the broader outlook. The political environment heading into the midterm cycle favors policies designed to maintain economic stability and support market confidence. Historically, administrations have sought to keep asset prices steady through election periods, and this cycle should follow suit. Looking further out, a new Federal Reserve chair under the Trump administration is expected to adopt a more accommodative stance with lower policy rates and a growth-oriented bias. Together, a brief early-year reset followed by renewed policy support and a favorable midterm election-year tone could set the stage for another leg higher in equities, potentially accompanied by a shift in market leadership as investors position for the next phase of the cycle.

REASONS TO BE BULLISH

• Positioning to Risk On: Many institutional investors remain overweight cash and short duration. A year end rally could force them back into the market as they chase performance.

• Productivity Tailwinds: Adoption of automation and AI continues to broaden into real-economy workflows, which supports margins and earnings durability.

• Easing Policy: If inflation cooperates, the projected path for policy rates becomes a favorable backdrop for valuations and financial conditions.

REASONS TO BE BEARISH

• Persistent Inflation: The last mile of disinflation has slowed. A flare-up would pressure valuations and delay policy flexibility.

• Debt Rollover Pockets: As we’ve discussed, if rates fail to decline sustainably, upcoming refinancing pressures could emerge, particularly across commercial real estate and other rate-sensitive markets.

• Policy and Data Uncertainty: A prolonged shutdown reduces visibility into economic data, specifically the labor market which appears to be seeing cracks for the first time since 2020.

PORTFOLIO HIGHLIGHTS & CURRENT THEMES

Our equity holdings continue to be led by the AI and data center buildout. The winners for us have been enablers of this cycle: semiconductors, networking, power equipment, and companies tied to the ultimate use cases of AI. Names like NVDA and the other MAG-7 continue to shine, while new additions to the portfolio like BABA have soared with Alibaba leading the way in AI abroad.

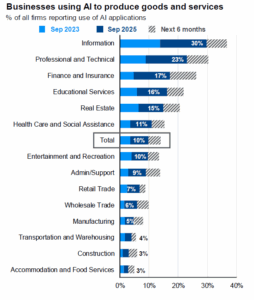

Source: JPMorgan

In our more aggressive portfolios, names across the AI value chain – from the NVDA semiconductor picks and shovels, to networking (ANET), data centers (VRT), power generation (VST), and ultimately software end-use cases (PLTR, CRWD) – have outperformed. Research shows the percentage of businesses using AI to produce goods and services has more than doubled across all sectors in the past 2 years. And this number is forecast to continue to grow by nearly 50% in the next 6 months+, with overall adoption still nascent (see chart above).

The “Industrial / Made in America” theme has also strongly contributed to performance. Reshoring and capacity upgrades are pulling through demand for electrical components, automation, advanced manufacturing tools, and logistics infrastructure. Our portfolio companies like CAT, as well the broad sector-level holdings XLI and ITA, have seen surging performance year-to-date.

We are also leaning into the “Debasement” theme. Despite inflation still running above target, the Fed quite clearly intends to continue its rate cutting cycle, which resumed in Q3. Growth, meanwhile, remains fairly solid. Against that backdrop, the dollar has experienced meaningful weakening this year, and alternative stores of value – like gold and Bitcoin – have soared. In the instance that things overheat in the coming years, we expect these types of assets (along with equities, generally) to continue to outperform. We’ve been adding gold exposure and, in our more aggressive portfolios, Bitcoin exposure. Sizing is deliberate and guided by our read of real yields and policy momentum.

Among the portfolio detractors have been healthcare names – under pressure from Trump’s campaign to make healthcare less opaque and more affordable, which has weighed on sector sentiment. Company specific problems for UNH have also caused it to stumble; however, it seems to be on the path to overcome this. The sector appears to be a great value now, especially as Trump seeks to encourage deals with companies. Across all themes our risk controls are unchanged – we aim to participate in durable trends, keep liquidity available for dislocations, and tailor exposure to fundamentals, momentum, and valuation.

CLOSING THOUGHTS

The third quarter reinforced a familiar setup. The economy continues to bend without breaking. Inflation is edging in the right direction but at a slower pace – and bumps still remain. Markets continue to reward durable themes, quality, and selective risk taking. As always, when we see opportunities, we want to participate with conviction. When risks outweigh rewards, we will adjust.

Sincerely,

Kyle DePaolo & Dane May