Roth IRAs: Conversions & The Backdoor Strategy

For high-income families, the Roth IRA represents one of the most powerful long-term planning tools available — a tax-free growth engine and a legacy vehicle wrapped in one. Yet for many earners, direct contributions are off the table due to income limits. The good news: there are still ways to access Roth benefits through Roth conversions and the Backdoor Roth strategy.

This post breaks down both — when each makes sense, what to watch out for, and how they fit into a broader wealth and tax strategy.

💡 THE CORE IDEA: WHY THE ROTH IRA MATTERS

Roth IRAs grow tax-free, and withdrawals in retirement are tax-free — no required minimum distributions (RMDs), and your heirs can inherit tax-free assets.

For families whose wealth will span multiple decades (and possibly multiple generations), this makes the Roth a cornerstone of tax diversification: the freedom to choose which accounts to draw from in different tax environments.

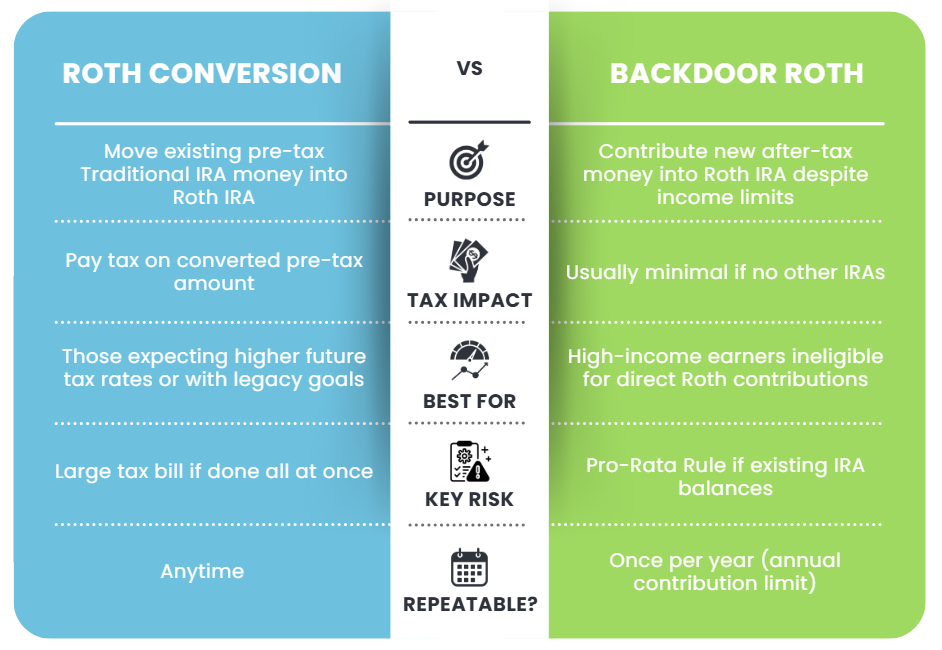

A Roth conversion means moving money from a pre-tax account (like a Traditional IRA or 401(k)) into a Roth IRA — and paying income tax now in exchange for tax-free growth later.

✅ WHEN A CONVERSION MAKES SENSE

• You expect higher future tax rates. If you’re early in your high-income years or anticipate rising rates, prepaying tax today may be cheaper.

• You want to eliminate future RMDs. Roth IRAs have none, allowing more control and compounding.

• You’re thinking long-term legacy. Beneficiaries can receive Roth assets tax-free, avoiding “forced income” under the 10-year inheritance rule.

• You have a low-income year. Converting in years with reduced income — e.g., business transition, time off, or post-sale gap — can take advantage of temporarily lower brackets.

🧾 KEY TAX CONSIDERATIONS

• The converted amount is taxed as ordinary income that year.

• Partial conversions let you “fill up” a specific tax bracket rather than jumping into the next one.

• Every conversion has a five-year rule: converted dollars must stay in the Roth for five years (or until age 59½) to avoid penalties.

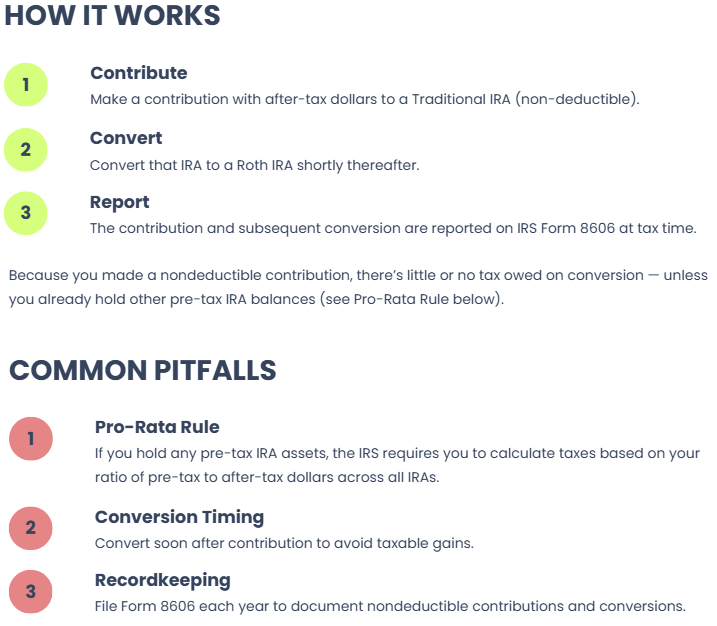

If your income is too high for a direct Roth contribution (phasing out around $150k single / $236k married filing jointly for 2025), you can still enter through the “backdoor.”

At DePaolo & May Strategic Wealth, we don’t view Roth conversions or backdoors in isolation — they’re tools within your larger wealth system.

🎯 COMBINE THESE CONCEPTS TO:

• Build tax diversification: Balance taxable, tax-deferred, and tax-free accounts for flexibility.

• Smooth lifetime tax rates: Converting strategically over time can reduce total lifetime taxes.

• Reduce future estate complexity: No RMDs and tax-free inheritance make Roths ideal for intergenerational planning.

• Fund long-term growth themes: Allocating high-growth, tax-efficient investments (AI, industrial innovation, etc.) into the Roth bucket can compound value tax-free for decades.

➡️ FINAL WORD

Whether through strategic conversions or the backdoor, the Roth IRA remains one of the most valuable long-term tools for high-income families.

By layering these strategies inside a disciplined investment framework, you gain what every family seeks — control, flexibility, and tax-free growth for generations.