Q1 2024 Quarterly Update

IN REVIEW: 2024 Q1

The 1st quarter of 2024 picked up right where we left off in 2023, as stocks continued to surge higher. Markets were buoyed by sustained economic strength, with 4th quarter’s GDP growth coming in above expectations at 3.4%. Growth expectations for 2024 ratched higher as well throughout the quarter, with GDP now expected to grow nearly 3% on the year as a whole. Manufacturing surveys seem to have bottomed in 2023 and have been trending higher for the year, and the employment picture has remained robust.

Alongside this strength, the S&P 500 was up 10.6% for the quarter. Trends in some of our favored areas, including artificial intelligence and healthcare innovation, continued strongly.

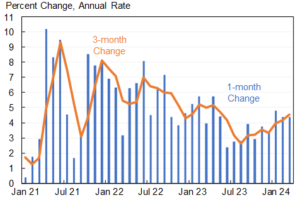

Also strong, however, were the readings on inflation. After falling precipitously in 2023, inflation has been sticky around its current 3.5% level, with month-over-month readings coming in sequentially hotter so far this year. In fact, annualizing the inflation readings year-to-date, inflation is currently running at a 4.6% pace.

Core CPI, 1 & 3 Month % Change (Annualized)

Source: BLS, Jason Furman

Bond markets have taken note. As of the writing date of this letter, general bond indices are down over 3% for the year, while longer-dated Treasurys are down nearly 10%. Investors have naturally been pushing yields higher again as the interest rate environment appears to embrace higher rates for longer. And hopes for a significant number of rate cuts have been all but dashed – futures markets are now pricing in at most two rate cuts for the year (down from seven). Commodities and gold have likewise rallied with inflation expectations ticking higher.

The Fed has also changed its tune over the course of the year. While not originally forecasting as many rate cuts as investors were pricing in, the Fed came into the year very constructive on the inflation path. As each of the last three month’s inflation readings have come in on the hotter side, the Fed has begun to acknowledge the stickiness of inflation and become more hesitant to cut rates anytime soon.

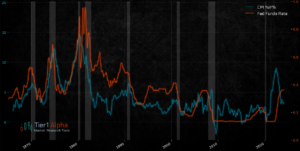

Indeed, history has shown that the Fed typically leaves rates above inflation for some time before inflation is fully vanquished. As the Fed has matured, however, they are attempting to use their deeper knowledge and data to bring rates down before leading the economy into recession, also the historical precedent. It remains to be seen how feasible this is.

CPI Year-over-Year vs Fed Funds Rate

Source: Tier1 Alpha

CURRENT CONDITIONS

Looking at the economy today, we have mixed conditions as our strong growth is creating a higher than anticipated inflation problem. This sticky inflation pushes markets to price-in higher rates, which ultimately impacts corporations, investors and individuals’ ability to finance new initiatives, ideas and big purchases. The result of this makes it extremely difficult for the Fed to assess whether they should be easing to get in front of a potential economic slowdown or raising rates to prevent runaway inflation.

WHAT’S AHEAD

Volatility in stocks finally started to emerge in April as investors weighed the current path of inflation and diminished hopes of imminent Fed cuts. After having rallied nearly 30% off their recent lows last October, and with arguably stretched valuations, markets seemed primed for a breather. Recent geopolitical flare-ups also concerned investors. This combination of higher than expected inflation readings and geopolitical turmoil seems to be a catalyst for the current equity pause, and potentially a bit deeper of a correction.

Going forward, markets will have to grapple with the seemingly higher growth, higher inflation environment. Or course, higher growth is generally a good thing for stocks. And while inflation remains above the Fed’s target, it is not too far from its longer term historical average. However, the budding uncertainty about the path of inflation, and how much longer this hotter trend will last, will likely keep markets on edge. If there is anything markets hate, it’s uncertainty.

The Fed, meanwhile, is in a tough position. Of course, the Fed wants to see inflation return to its downward trend toward the 2% target. Having declared an end to the rate hikes, the Fed and markets would hate nothing more than to see a course reversal with even higher rates being necessary to rein in inflation. But despite the continued economic strength, there are emergent signs that the tightening cycle is beginning to cause cracks in the economy.

Commercial real estate has obviously been under significant pressure, and there is a coming wall of loan maturities that will be difficult (if not impossible) to refinance under current conditions. Nearly $1 trillion in commercial mortgages are maturing in 2024 alone, while many buildings are trading at a fraction of their values only a few years ago. Only the brighter side, about 1/3 of this debt is in the multifamily space, where building prices have held up considerably better.

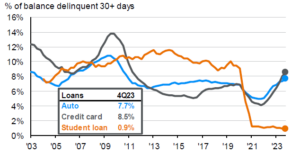

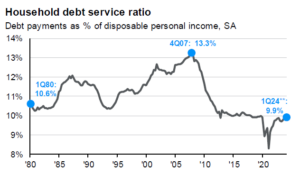

Consumers, meanwhile, have been increasingly relying on debt to replace dwindling surpluses they built up during covid times. Concerningly, credit card and auto loan debts delinquencies have been steadily rising, now hovering near levels not seen since the 2007-2010 era. This is somewhat curious however, as household debt service levels remain historically low. Those without the benefit of ultra-low mortgages are likely to be feeling pinched the most.

Consumer Loan Delinquencies

Source: JPMorgan

Thus, the Fed needs to use its policy tools to cut rates before the economy cracks too much, while being cautious of the recent re-ignition in inflation and keeping inflation expectations well-anchored. Not an easy feat.

REASONS TO BE BULLISH

Election year: As we have noted before, election years are historically bullish for equity markets providing positive annual returns 85% of the time. With populism on the rise, both Biden and Trump want to appease potential voters with tax cuts, subsidies, loan forgiveness and other “stealth” stimulus that boosts consumer confidence and spending. Consumption is at its highest when confidence is high and consumers feel secure in their jobs and their ability to service debt.

Fiscal Spending: We have a government that is on pace to run a $2 trillion deficit this year. Providing stimulus across industries with an emphasis in manufacturing, defense contractors, healthcare and agriculture. We typically only see this kind of deficit spending when we are in recession and/or war. Pumping this additional capital into the economy will inflate nominal GDP and along with it equities, housing and commodities.

Consumer Strength: The aforementioned fiscal spend and stealth stimulus have led to economic strength allowing workers to benefit from higher wages and feel secure in their jobs. Layer in household debt service ratios being historically low and we have a set up for the consumer to continue to spend confidently.

Household Debt Service Ratios

Source: JPMorgan

Easing of Financial Conditions: In the event the Federal Reserve decides to proactively cut the risk free rate, investors will find equities incrementally more attractive as the total return for holding short duration fixed income falls. The last decade has significantly rewarded investors who have embraced risk assets and many are now conditioned to respond by buying at the first hint of rate cuts.

REASONS TO BE BEARISH

Overheating Economy: From our perspective, the Fed may be prioritizing economic growth over controlling inflation. If they continue to be dovish and maintain accommodative policy despite inflation this could lead to stagflation. Stagflation is an environment with high inflation and slow economic growth and leads to negative outcomes and underperformance for both equities and bonds with any duration.

Geopolitical Risk: High inflation has historically led to increased global tension. Oftentimes countries feel the need to shift policy more towards protectionism to hyper focus on their own economic interests. These can include key industries, commodities or their unique labor force. This insulation often perpetuates the inflation problem, increases de-globalization and has historically led to many conflicts and hot wars.

Valuations / Equity Allocation: S&P 500 year-over-year earnings growth is expected to come in at 10.9% this year which is quite optimistic in the face of the inflation and geopolitical risks ahead. Additionally, the current next 12 months price to earnings (P/E) ratio is 20.4. This is elevated relative to the 5-year average (19.0) and the 10-year average (17.7). Last but not least household equity allocations are riding high (see below image). This does not mean we have a bear market tomorrow, but it means there are fewer marginal new buyers to step in without additional leverage and/or liquidity added to the system.

Excessive Equity Exposure & Future Stock Performance

Source: Hi Mount Research

CLOSING THOUGHTS

In view of the above, stocks will likely experience some mixed performance in the near term, while investors weigh a generally stronger economy (albeit with some cracks) against uncertainty about the path of inflation and Fed rates. Bonds remain generally unappealing except for those with the shortest maturities. Commodities and gold have shined with the resurgence in inflation, but could give back these sharp moves higher if hotter inflation pauses or moves down. Alternatives continue to be a desirable hedge and source of uncorrelated returns.

If inflation challenges worsen, economic cracks widen, or geopolitical tensions exacerbate, expect us to de-risk the portfolios utilizing the high yields available in short duration bonds and uncorrelated alternatives. Absent a material worsening of the outlook, the recent pullback likely represents an opportunity to incrementally increase equity exposure, particularly given the continued economic strength, constructive jobs outlook, and seasonally favorable market outcomes during an election year.

Notably, market performance tends to accelerate post-election as the uncertainty about the party is lifted, regardless of party outcome.