Maximizing Year-End Tax Strategies for 2024

As we approach the end of the year, it’s time to think strategically about your taxes. There are many unique opportunities to optimize your tax position, but timing is everything. Here are the key strategies you should consider to make the most of your financial situation for the 2024 tax year.

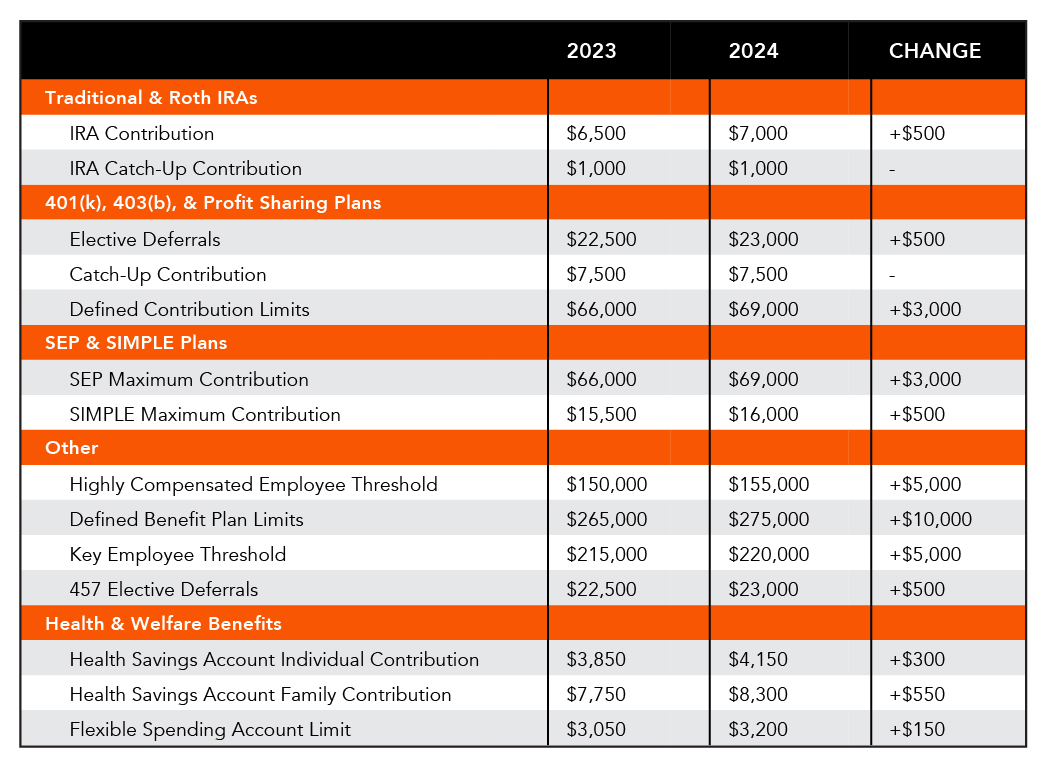

1) MAX OUT RETIREMENT CONTRIBUTIONS

One of the most effective ways to reduce taxable income is by maximizing contributions to tax-advantaged retirement accounts. Whether you’re an employee or self-employed, here’s what to keep in mind for 2024.

FOR EMPLOYEES:

• 401(k): The maximum contribution to a 401(k) in 2024 is $23,000 (or $30,500 if you’re over 50). These pre-tax contributions reduce your taxable income directly, making it essential to max out if possible before year-end.

• Traditional/Roth IRA: For 2024, you can contribute up to $7,000 (or $8,000 if you’re over 50) to a Traditional or Roth IRA. Depending on your income and participation in employer-sponsored plans, these contributions may also be tax-deductible.

FOR SELF-EMPLOYED INDIVIDUALS:

• Solo 401(k): The Solo 401(k) is an excellent retirement vehicle for self-employed individuals or small business owners without employees. For 2024:

Employee Contribution: You can contribute up to $23,000 (or $30,500 if over 50).

Employer Contribution: As the employer, you can contribute up to 25% of your net earnings, with a total contribution limit of $69,000 for 2024 (or $76,500 if you’re over 50).

• SEP IRA: A SEP IRA allows self-employed individuals or small business owners to contribute up to 25% of their compensation, with a 2024 maximum limit of $69,000. It’s a straightforward option for those looking to reduce taxable income while contributing significant amounts to their retirement.

In many instances, it may be possible to defer these contributions – particularly the employer contributions – until you (or your business) files taxes in the following year. This generally includes contributions to individual Traditional or Roth IRAs. However, best practice would be to make the contribution during the current tax year to avoid any complications.

2) LEVERAGE TAX-LOSS HARVESTING

Market volatility can create opportunities for tax-loss harvesting, which allows you to sell underperforming investments and use those losses to offset capital gains. This can significantly lower your tax liability, especially if you’ve had a strong year with other investments.

KEY POINTS:

• Losses can offset gains, and if your losses exceed your gains, you can deduct up to $3,000 against ordinary income.

• Any additional losses can be carried forward to future tax years.

• Be mindful of the “wash-sale rule,” which disallows the repurchase of the same or substantially identical securities within 30 days before or after the sale.

3) CONSIDER CHARITABLE GIVING

If charitable giving is part of your wealth plan, doing so before year-end can offer significant tax benefits. Gifts to qualified charities may help reduce your taxable income while making a positive impact.

KEY POINTS:

• Cash donations to public charities can typically be deducted up to 60% of your adjusted gross income (AGI).

• Donating appreciated securities, such as stocks, can allow you to avoid capital gains taxes while still deducting the full market value of the donation.

• Consider using a donor-advised fund to make charitable contributions, which offers flexibility in timing donations and immediate tax benefits.

4) REVIEW YOUR ESTATE PLAN & ANNUAL GIFT EXCLUSIONS

Year-end is a perfect time to review your estate plan and consider making tax-efficient gifts to family members. The IRS allows you to give up to $18,000 per recipient per year without incurring gift taxes, which can help reduce the size of your taxable estate.

KEY POINTS:

• High-net-worth individuals should take advantage of the annual gift tax exclusion to transfer wealth without tax consequences.

• Married couples can double the exclusion amount, allowing them to gift up to $36,000 per recipient in 2024.

• Consider gifting appreciated assets like stocks, which can offer additional tax benefits.

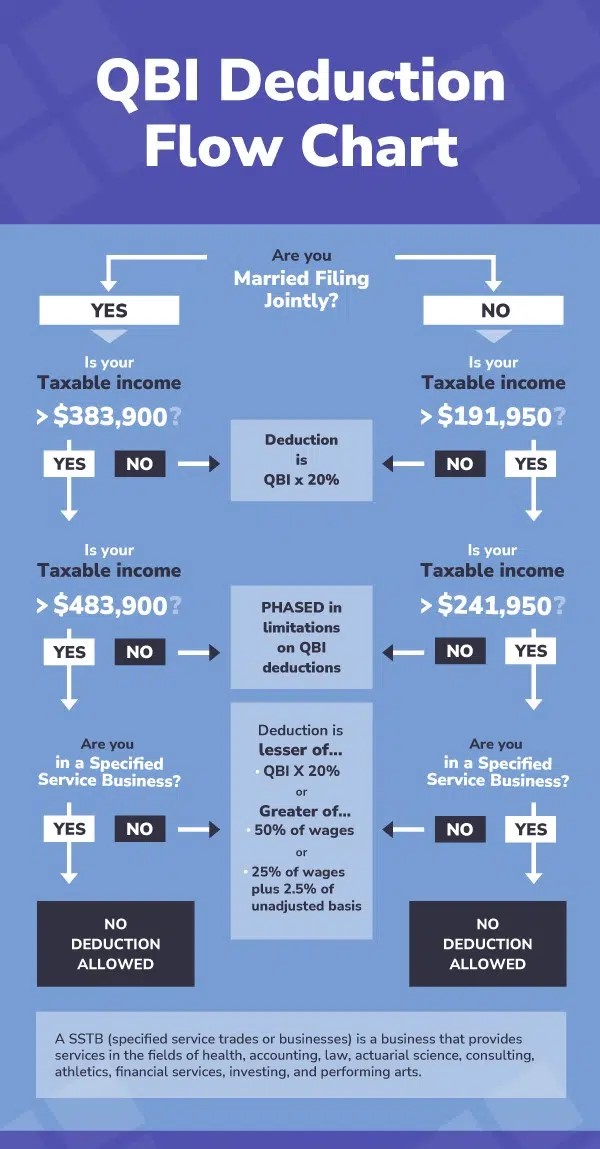

5) TAKE ADVANTAGE OF THE QUALIFIED BUSINESS INCOME (QBI) DEDUCTION

For those with pass-through business income, such as from an LLC, S-Corp, or partnership, the Qualified Business Income deduction can offer a significant tax break. You can deduct up to 20% of your QBI, but certain income thresholds and restrictions apply.

KEY LIMITS FOR 2024:

• Single Filers: If your taxable income is below $191,950, you can claim the full 20% deduction on your QBI. The deduction begins to phase out if your income is between $191,951 and $241,950.

• Joint Filers:For married couples filing jointly, the phase-out range starts at $383,900 and the deduction completely phases out at $483,900.

MAXIMIZING THE DEDUCTION:

• If your taxable income is within or above these ranges, the deduction will be limited based on factors such as W-2 wages paid by the business and the value of qualified depreciable property.

• Strategies to maximize the QBI deduction include aggregating income from multiple businesses or managing your retirement contributions and business expenses to stay within the eligibility thresholds.

High-income earners, particularly those in specified service trades or businesses (SSTBs) like consulting, financial services, and law, need to be especially mindful, as the deduction may completely phase out at higher income levels.

THE BOTTOM LINE

Year-end tax planning can be complex, but the benefits of carefully considered strategies can be substantial. By maxing out retirement contributions, utilizing tax-loss harvesting, making strategic charitable gifts, reviewing estate planning opportunities, and leveraging the QBI deduction, you can significantly reduce your tax burden for the year.

At DePaolo & May, we specialize in helping affluent individuals and families navigate the intricacies of tax strategy and wealth management. Reach out to us today to ensure that you’re taking full advantage of these opportunities before the year ends.